The U.S. Nonfarm Payrolls and Unemployment Rate are out this coming Friday, June 1st, 2018, at 13:30 UK Time, and are expected to cause significant volatility in the markets.

An economic indicator that tends to trigger sharp market movements in the minutes leading up to its release and afterwards, the NFP is usually released by the U.S. Department of Labor on the first Friday of each month, outlining changes in the number of employees, excluding farm workers and those employed by the government, non-profit organisations and private households.

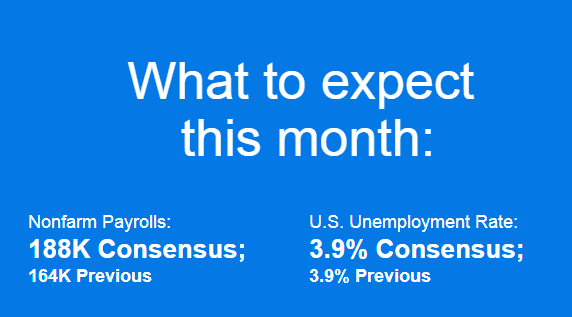

Market consensus for this week’s May Nonfarm Payrolls is forecast to show that the U.S. economy added 188K jobs – a higher number than last month’s “worse than expected” figure of 164K. The Labour market in the U.S. remains strong and the markets will be looking for an improvement in May’s release from April’s data. The markets will also be closely watching the annualized average hourly earnings figure, which came in at 2.6% in April, with many forecasts calling for May’s release to come in stronger at 2.7%. Such positive data will underscore the strength of the U.S. economy.

If we see a significantly bad NFP release of < 125K, coupled with an Unemployment Rate > 4.0%, the markets will most likely see USD come under downward pressure. A strong NFP release of >225K, with the Unemployment Rate below 3.9%, will likely result in USD strengthening.

As always, it will be important to note any revision from the previous month (164K) as this will impact market sentiment regardless of the current release.

Keep in mind:

- During the NFP announcement, expect high volatility, especially across USD pairs.

- Market sentiment can really affect currency movements. What traders expect from the report has as much impact as the actual released data, if not greater.

- A higher figure than the one registered during the previous month signifies an improvement in employment numbers. This, as well as the release of a higher-than-expected figure, mean an increase in the number of jobs created and are positive for both the U.S. economy and the dollar.

- A lower figure than the one registered during the previous month, as well as a lower-than-expected figure, usually have a negative impact on the dollar as they demonstrate a drop in employment numbers.

- Remember that the sudden spike observed across the charts of many currency pairs upon the release of the NFPs is usually followed by a period during which the market tries to recover and return to its initial price levels.

Categories :

Tags : Friday's NFPs