Forex Market Trading Hours: Best Times to Trade & Why They Matter

In the world of forex trading, timing isn’t just important — it’s everything. While the forex market operates 24 hours a day, 5 days a week, that doesn’t mean every hour offers the same opportunities. Knowing the best forex trading hours helps traders optimize their strategies, avoid low-volume traps, and stay in sync with global momentum.

🌍 What Are Forex Market Trading Hours?

The forex market is a decentralized, global market — which means it doesn’t operate from a single place, nor does it close when the clock strikes five. Instead, it follows a rolling schedule that mirrors the working hours of major financial centers around the world.

Forex trading begins each week on Sunday at 5 PM EST with the Sydney session and closes on Friday at 5 PM EST with the New York session.

Main Trading Sessions (in GMT):

- Sydney: 10 PM – 7 AM

- Tokyo: 12 AM – 9 AM

- London: 8 AM – 5 PM

- New York: 1 PM – 10 PM

What Are Forex Market Trading Hours

What Are Forex Market Trading Hours

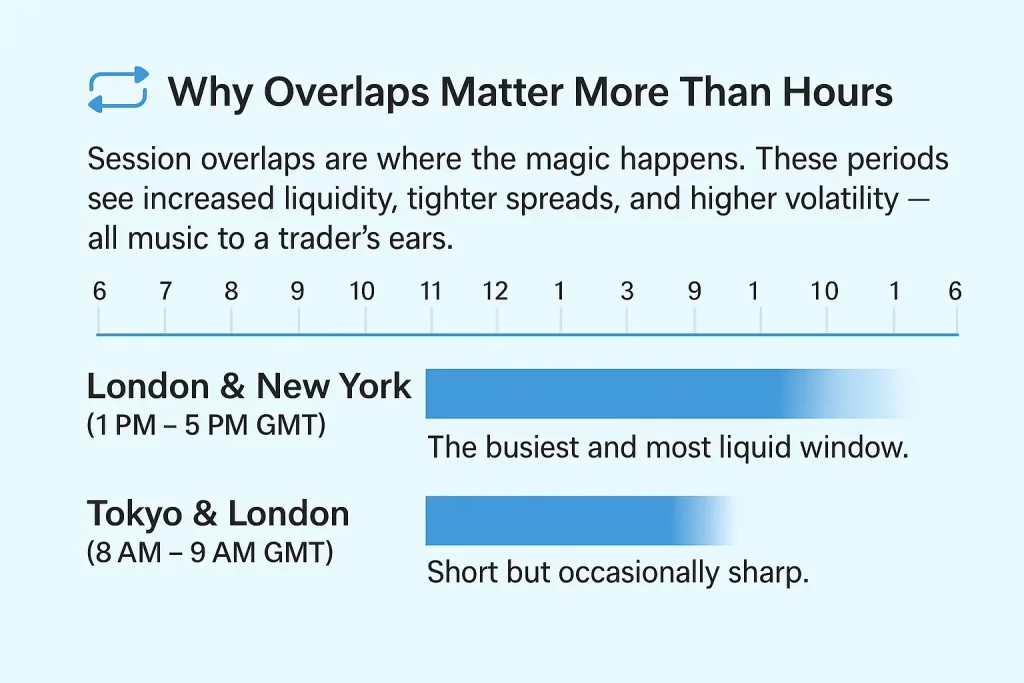

🔁 Why Overlaps Matter More Than Hours

Session overlaps are where the magic happens. These periods see increased liquidity, tighter spreads, and higher volatility — all music to a trader’s ears.

Key Overlaps:

- London & New York (1 PM – 5 PM GMT): The busiest and most liquid window.

- Tokyo & London (8 AM – 9 AM GMT): Short but occasionally sharp.

Why Overlaps Matter More Than Hours

Why Overlaps Matter More Than Hours

During these windows, major news releases (like NFP or ECB statements) and big institutional orders can move the market fast. It’s a scalper’s playground and a trend-trader’s opportunity zone.

🧭 Best Hours to Trade Based on Strategy

Not all hours are equal — and neither are all strategies. Here’s what suits what:

| Strategy Type | Ideal Time (GMT) | Reason |

|---|---|---|

| Scalping | London/NY Overlap | Fast movement, tight spreads |

| Range Trading | Tokyo Session | Lower volatility, predictable price zones |

| Breakout Trading | Start of London Session | Often new trends emerge |

| News-Based Trading | 12:30–14:00 GMT | Major economic releases (U.S., Eurozone) |

Best Hours to Trade Based on Strategy

Best Hours to Trade Based on Strategy

📊 Market Behavior by Session

Each forex session has its own ‘mood’ — here’s how to match your moves:

Sydney (Quiet but Foundational)

- Low liquidity, high spreads early on

- AUD, NZD pairs are most active

Tokyo (Slow and Technical)

- Smooth price action, fewer fakeouts

- Best for range-bound or patient traders

London (The Pulse)

- Biggest moves start here

- Ideal for EUR, GBP, CHF pairs

New York (Volatile and Responsive)

- Reacts to London trends

- U.S. data drives wild swings

Market Behavior by Session

Market Behavior by Session

🧠 Real-World Trading Tips

- Avoid Trading During Rollover: Around 5 PM EST, spreads widen sharply.

- Use Pending Orders: Set entries before overlaps to catch breakouts.

- Track the News: Tools like ForexFactory help anticipate volatility.

- Focus on Pairs That ‘Belong’ to the Session: e.g., USD/JPY during Tokyo.

- Plan Based on Your Local Time Zone: Don’t force trades outside your natural schedule.

❌ Common Mistakes When Timing Trades

- Trading Every Session: Leads to fatigue and poor decisions.

- Ignoring Time Zone Differences: Mistiming trades = missed setups.

- Blindly Following Volatility: High movement ≠ high probability.

- Assuming Fridays Are Safe: Liquidity often fades early before the weekend.

🔄 Time Zone Conversion Matters

Many new traders miscalculate when each session starts in their own time zone — especially with Daylight Saving Time in effect. Use tools like:

- TradingView (Session Indicators)

- Market 24h Clock

- MyFXBook economic calendar

❓ Frequently Asked Questions (FAQ)

Q1: What time does the forex market open in Canada?

Around 5 PM EST on Sunday — aligns with the Sydney session.

Q2: What are the best forex trading hours for beginners?

London–New York overlap is ideal for clear signals and momentum.

Q3: Is forex open on weekends?

No. It closes Friday 5 PM EST and reopens Sunday 5 PM EST.

Q4: Should I avoid the Sydney session?

Not necessarily. It’s slower, but good for strategic planning and AUD/NZD trades.

Q5: Can I trade forex at night?

Yes, but avoid low-volume windows unless your strategy is built for it.

✅ Final Takeaway

Smart traders don’t just know the market — they know when to enter it. Time awareness is as critical as chart patterns and economic indicators. Whether you’re a beginner or a seasoned trader, mastering when to trade is half the battle won.

🔗 Looking for a reliable platform to match your strategy and timezone? Check out our Top Binary Options Brokers for trusted choices.

Categories :

Tags :