[text]

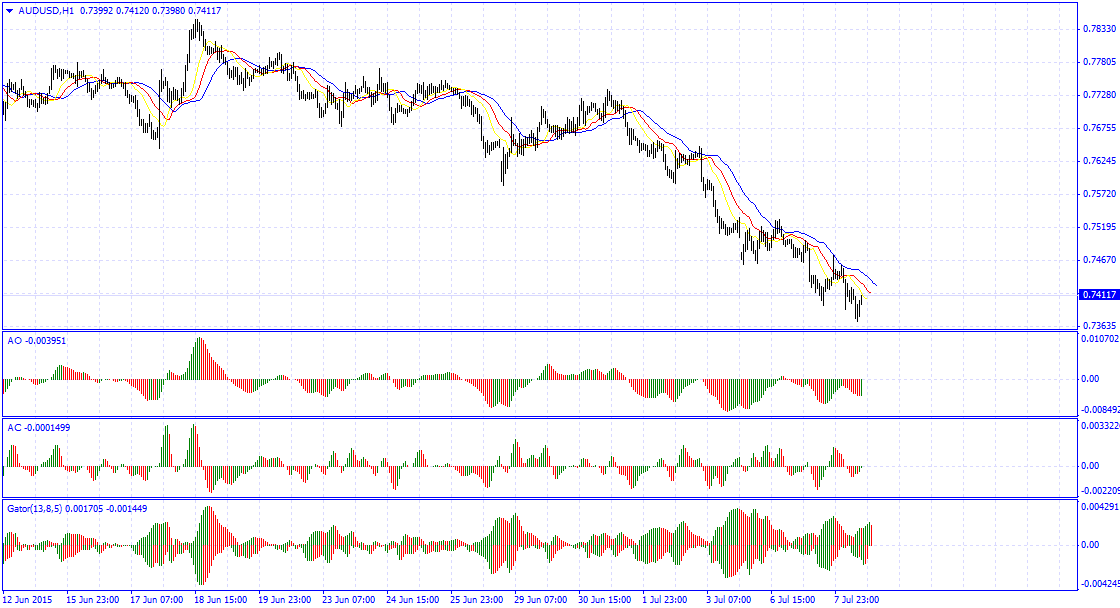

AUD/USD Fundamental Analysis (2015.07.08)

The AUD/USD followed global stress and declined as traders moved to safe haven and commodities tumbled. The Aussie is down 43 points to 0.7409. Iron ore prices fell to new lows weighing on the Aussie while stress over China’s declining equities market and shrinking economy is hurting the AUD. The Australian dollar, which is a proxy for Chinese investments, fell 0.7 percent.The Australian dollar has continued its recent slide, falling briefly below 74 US cents overnight for the first time since 2009, when it fell in the wake of the global financial crisis.Global volatility fuelled by China and Greece has been driving the currency’s recent fall from grace, and the same factors also continued to weigh overnight on Australia’s most important commodity, iron ore.

The Chinese benchmark iron ore price fell below $US50 a tonne for the first time since April, down to $US49.70. The price has dropped nearly 16 per cent in just a week. The price of iron ore has plunged below $US50 a tonne in offshore trade as the market rout in China damages confidence in the economy of the world’s largest consumer of the commodity.Australians are paying off their credit cards and saving more, but HECS debt is at a 14-year high. Record low interest rates are helping people pay their debts, with four out of 10 households debt free in the June quarter, a report by St George and the Melbourne Institute shows.It was also another volatile night for stocks, with Wall Street gaining ground but another round of heavy European losses as the Greek debt crisis remained unresolved.

AUD/USD Chart

Source: FXEMPIRE

[/text]

Categories :

Tags : AUD AUD/USD AUD/USD News