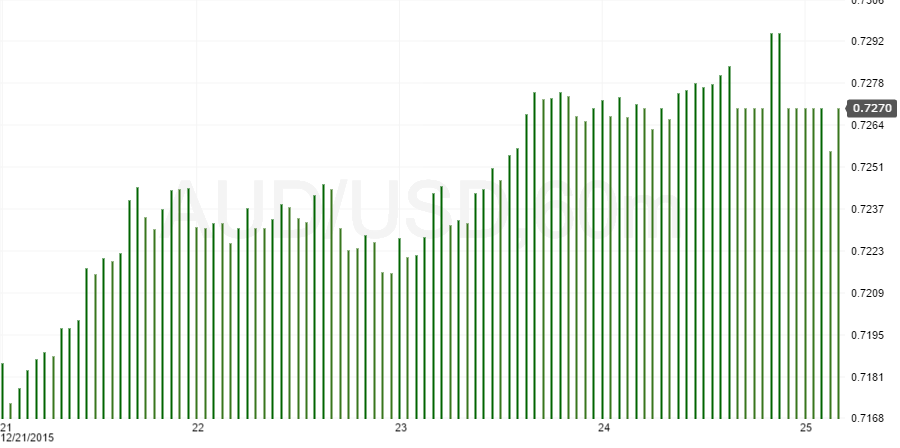

AUD/USD Fundamental Analysis(2015.12.28)

The AUD/USD gained 5 points to trade at 0.7274 as commodities try to rebound and the jump in oil prices lifted the commodity linked currencies. Australia is closed for the extended holiday celebration. If there’s one thing Australian markets types love to talk about at present, it’s the slumping iron ore price.

The price decline has got financial markets talking, with analysts seemingly trying to outdo each other by forecasting ever-lower prices.

It’s collapsing and some high-cost, high-profile miners are likely to follow suit. There’s a sense of doom saying about this; it’s going down the gurgler, taking the industry and Australia with it.

There’s little doubt that the outlook for iron ore remains bleak, with a massive supply glut continuing to build as seaborne supply ramps up and global demand weakens, particularly from the world’s largest consumer, China. Many predict that it will take years for the market to find equilibrium, weighing on prices in the interim.

China’s reduced demand for iron ore amid a glut of supply has driven the market price of high-quality iron ore more than 60% lower since the beginning of 2014. The glut was the result of lower cost miners, such as BHP Billiton (ASX: BHP) and Rio Tinto, increasing production to ratchet up the pressure on smaller, high-cost producers.

Worrying signs have emerged across the market. S&P recently lowered its iron ore price forecasts and said it was monitoring eight of the world’s largest iron ore producers for possible credit downgrades, including BHP, Rio and Fortescue Metals Group.

Australia’s number four producer Atlas Iron Group announced a suspension of all mining activities, prompting several mining services companies to make announcements of their own.

FxEmpire provides in-depth analysis for each asset we review. Fundamental analysis is provided in three components. We provide a detailed monthly analysis and forecast at the beginning of each month. Then we provide more up to the data analysis and information in our weekly reports, which covers the current week and are published by Sunday before the new week begins. Daily we share any new events, forecasts or analysis that affect the current day. To achieve a full accurate understanding it is important that you study all of our data and analysis as a whole.

Today’s economic releases:

| Cur. | Imp. | Event | Actual | Forecast | Previous | ||

| Holiday | Canada – Boxing Day | ||||||

| Holiday | New Zealand – Boxing Day | ||||||

| Holiday | Australia – Proclamation Day | ||||||

| Holiday | United Kingdom – Boxing Day | ||||||

| JPY | Industrial Production | -1.0% | -0.6% | 1.4% | |||

| JPY | Retail Sales (YoY) (Nov) | -1.0% | -0.6% | 1.8% | |||

Source: Fxempire

Categories :

Tags : AUD/USD AUD/USD Fundamental Analysis