[text]

Forex Market News

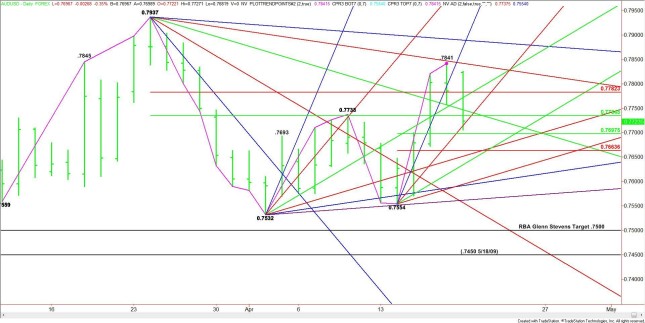

AUD/USD news and Technical Analysis

It looks like Reserve Bank of Australia Governor Glenn Stevens may get a .7500 AUD/USD after all, following a speech in New York which raised the prospect of an interest rate cut as soon as next month.Mr. Stevens told a Goldman Sachs audience “The fact that output is below conventional estimates of ‘potential’, aggregate demand still seems on the soft side … unemployment is elevated. So interest rates should be quite accommodative and the question of whether they should be reduced further has to be on the table.”

aud/usd chart

Stevens’ comment is expected to keep the pressure on the Aussie Dollar over the near-term. On Monday, sellers followed through to the downside following Friday’s potentially bearish closing price reversal top. Based on the short-term range of .7554 to .7841, the primary downside target today remains its retracement zone at .7697 to .7664.Yesterday’s close is giving the market an early downside bias because it also put the Forex pair on the bearish side of a pair of angles at .7754 and .7837. Additionally, the market closed on the weak side of a retracement zone at .7734 to .7782.

If the downside momentum continues today then look for sellers to take out the short-term 50% level at .7697. This could trigger a further break into the Fibonacci level at .7664 and a pair of uptrending angles at .7662 and .7654.The daily chart opens up to the downside if .7654 is taken out with conviction with potential targets at .7604 and .7597.The two bottoms at .7554 and .7532 must hold or the AUD/USD will test Mr. Stevens .7500 target before the RBA’s May 5 meeting.Look for a downside bias today and treat any intraday rallies into resistance as fresh shorting opportunities. The tone should be bearish as long as the market stays under .7734.

Source: fxempire

[/text]

Categories :

Tags : AUD/USD forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf Forex Market Analysis forex tutorials for beginners pdf how to trade forex for beginners pdf learning forex trading pdf Reserve Bank of Australia