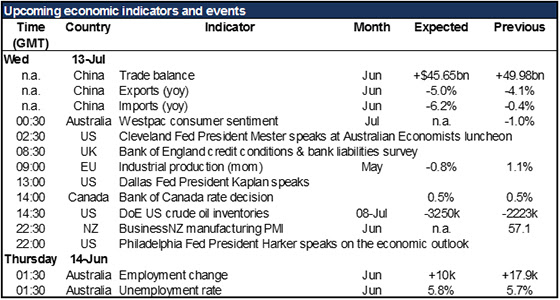

Bank of Canada Rate Announcement – The Bank of England releases its quarterly reports on credit conditions and on banks’ liabilities. Normally these reports are of interest largely to specialists, but this time around they may be of wider importance to the market as they will help the Bank assess what kind of response is necessary to the Brexit vote. Already the Bank rescinded a rule to increase the amount of capital that banks would have to hold against their loan portfolio, freeing up an estimated GBP 150bn for banks to lend. Any indications that they could further relax the regulations could help the pound.

EU industrial production is forecast to fall on a mom basis, which could be slightly negative for the euro. It appears that output in Q2 is decelerating from the Q1 pace, which is not good.

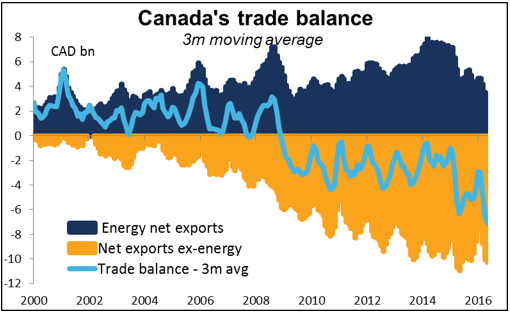

The big event of the day of course is the Bank of Canada rate decision. The BoCis unanimously expected to keep rates stable at this meeting, with a 25% chance that they cut at some point before the end of the year. There are lots of reasons for them to ease rates. Most notably, BoC Gov. Poloz was hoping for an export-led recovery, but on the contrary the April trade deficit was the largest on record and May wasn’t far behind. The labour market too is relatively weak. A rate cut would help to weaken the currency and thereby boost exports and jobs.

Source : Fxprimus Forex Broker (Review and Forex Rebates Up to 85%)

Categories :

Tags : Bank of England EU industrial production forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf forex tutorials for beginners pdf FXPRIMUS Forex Broker GBP how to trade forex for beginners pdf learning forex trading pdf