Bank of Canada, Bank of England meeting – Usually the week of the month following the nonfarm payrolls is rather quiet, but this week we have several points of drama to watch for. As usual nowadays, the UK will be in the spotlight, with the Bank of England Monetary Policy Committee (MPC) decision on Thursday. The Bank of Canada also meets on Wednesday. There are also a large number of important US indicators, especially on Friday, and a raft of Fed speakers throughout the week. Finally, there are a large number of important Chinese indicators coming out, including the crucial GDP figure.

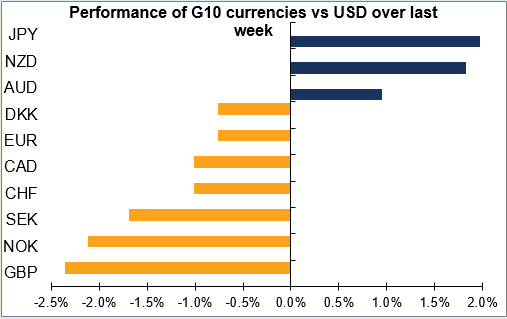

The best-performing G10 currencies were JPY, NZD and AUD. That’s difficult to reconcile, given that JPY rises during “risk off” periods while NZD and AUD tend to be “risk on” currencies. Fed rate expectations barely budged after Friday’s better-than-expected nonfarm payrolls (up 1-3 bps), indicating that the market doesn’t think that the number will have changed their view. The Fed expectations and the FX market views suggest we are in a kind of “sweet spot” where growth is not so strong as to trigger tightening yet not so weak as to derail the global economy. In such a situation, investors may go for yield and carry trades, which would explain the attraction of AUD and NZD.

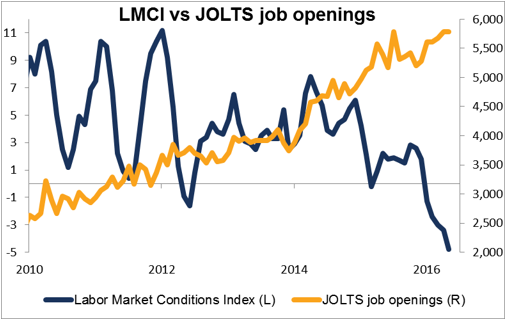

Personally, I question this view: I think the US labor market is still improving. In that respect, today’s Labor Market Conditions Index (LMCI) and tomorrow’s Job Openings and Labor Turnover Survey (JOLTS) report, while not market-moving, may be important for Fed members in making up their minds. In that respect, the expected reversal in the LMCI’s downtrend today could help to support the dollar.

Source: Fxprimus Forex Broker (Review and Forex Rebates Up to 85%)

Categories :

Tags : Bank of Canada Bank of England meeting forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf Forex Market Analysis forex tutorials for beginners pdf FX Market FXPRIMUS Forex Broker how to trade forex for beginners pdf learning forex trading pdf