Big day for the British pound – The Bank of England’s monetary policy meeting today will be the big event as the markets brace for a rate cut. What will determine the price action in GBPUSD will be how much the BoE can loosen monetary policy, which if disappoints could see a strong short squeeze that could shake out the weak short positions at the current levels. Watch for GBPUSD’s breakout above $1.34, while $1.28 remains the lower end of the range.

EURUSD Daily Analysis

EURUSD (1.1143): EURUSD closed bearish following the retest to 1.120 and gave up Tuesday’s gains completely. Interestingly, following the upside breakout from the inside bar previously noted, the Tuesday/Wednesday price action in EURUSD has perhaps caught a lot of weak long positions on the wrong side of the market. A close below 1.11492 is essential to confirm the move to the downside, where support at 1.110 – 1.1076 is likely to be targeted. Looking at the Stochastics on the 4-hour time frame, the lower low in Stochs compared to the higher low in price is likely to see some near term bounce to the upside on a dip to 1.110 – 1.076.

USDJPY Daily Analysis

USDJPY (101.23): USDJPY broke down below the 102 support, but the declines have been limited so far. The daily chart shows a potential for price to recover from current lows on a close back above 102.00. However, the 4-hour chart still hasn’t signaled any upside bias just as yet. Following the low formed below 101, USDJPY needs to bounce off the current level to form a higher low on the pullback. As such, watch for 102 level acting as resistance in the near term. A confirmed break down below 101 could see USDJPY extend declines to 100.

GBPUSD Daily Analysis

GBPUSD (1.332): GBPUSD remains firmly above 1.32 despite yesterday’s price action being fairly limited. With today’s BoE meeting on the horizon, GBPUSD could see some volatility led price moves. Watch for a pullback to the support at 1.32 as the upside bias is likely to continue on a breakout above 1.34 – 1.3488, which would mark the inverse head and shoulders pattern breakout, targeting 1.38 and potentially to 1.40. To the downside, a break down below 1.32 – 1.30 could signal further declines in GBPUSD to 1.280 support.

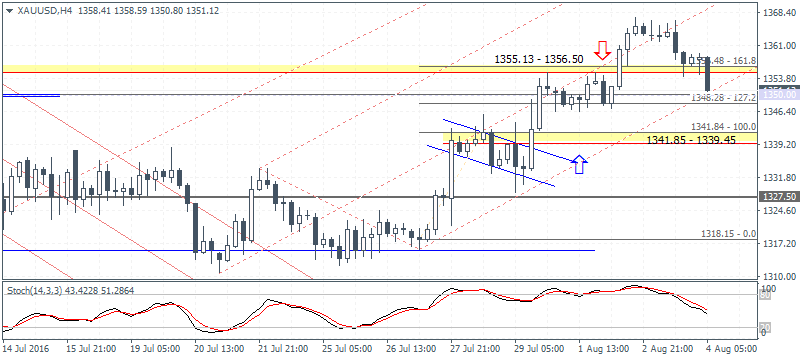

Gold Daily Analysis

XAUUSD (1351.12): Gold prices were bearish yesterday but formed an inside bar near the 1360 top. A close below yesterday’s low at 1347.20 will confirm near term declines with support at 1315.20 – 1300 likely to stall the declines in the near term. On the 4-hour chart, there is a potential for gold prices to retest the 1355 – 1357 price level to test for resistance before declining further. On the intraday basis watch for gold to hold up near 1341.85 – 1340 support.

Source: Orbex Forex Broker (Review and Forex Rebates Up to 85%)

Categories :

Tags : British pound EUR/USD forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf forex tutorials for beginners pdf GBPUSD Daily Analysis how to trade forex for beginners pdf learning forex trading pdf Stochastics USDJPY Daily Analysis