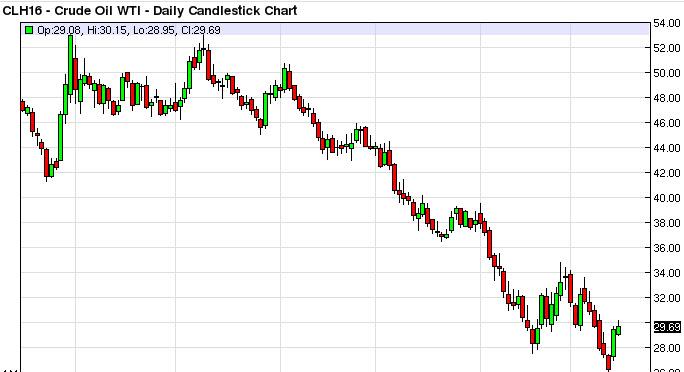

The light sweet crude market rallied slightly during the course of the day on Monday, testing the $30 level. Ultimately, the market found that area to be a bit too resistive, as we pulled back slightly. This used to be a supportive level, and now should be resistance area. By doing so, the market looks as if it is ready to start falling again, and with that it is probably able to be sold in this general vicinity. Ultimately, the market should continue to go towards the $26 level. Ultimately, that level might be supportive but we think that the target is going to be closer to the $25 handle.Rallies at this point in time should see plenty of resistance as well, as the $34 level above is essentially the ceiling of the market right now and with that we are only selling this particular commodity at this point in time. We really have no interest in trying to fight the longer-term downtrend.

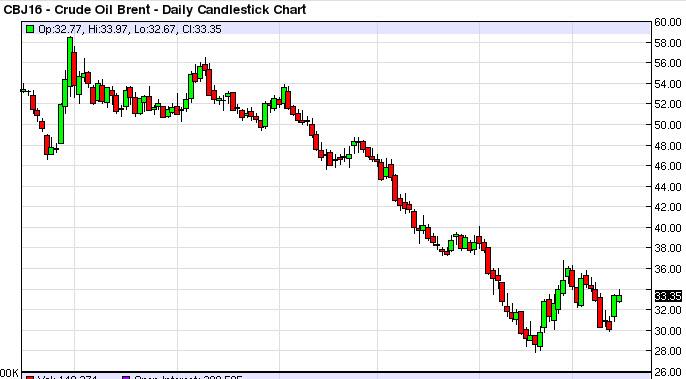

Brent markets tried to rally as well, but struggled at the $34 level. By doing so, the pretty much mirror the light sweet crude market, as one would expect. Ultimately this is a market that should drive its way back down to the $30 level, and then perhaps the $28 level. We have no interest in buying this market, even though we have not made a fresh, new low. We think that it’s only a matter time before the bearish fundamentals take over again, as there is simply far too much in the way of supply out there right now. We do not think that’s going to change anytime soon, and industry insiders are suggesting that we could be looking at a decade of soft oil prices.With this, we sell every time this market rallies and shows any type of exhaustion as a result. Yes, there will be rallies from time to time that are a little bit stronger than anticipated, but this should be one of the easiest trades to take, shorting any grade of oil.

Source: FXEMPIRE

Categories :

Tags : Oil Oil Market Oil News