Crude Oil Technical Analysis(2016.03.03)

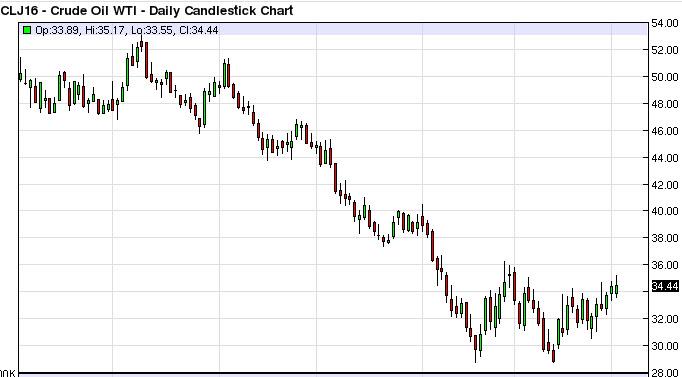

WTI Crude Oil

The WTI Crude Oil market initially rallied during the course of the day on Wednesday, but turned back around to form a bit of a shooting star. We continue to see quite a bit of resistance at the $35 level, an area that of course has a fairly strong amount resistance, and of course is a large, round, psychologically significant number. This shooting star signifies that we will continue to consolidate in our opinion. If we break down below the bottom of the range for the day on Wednesday, the market could drop down to the $32 level, possibly the $30 level.Even if we break above here, there is more than enough resistance all the way to the $40 level to him keep this market fairly bearish. Ultimately, this is a “sell only” market at this moment although there has been quite a bit of headline pressure out there lately to push markets higher.

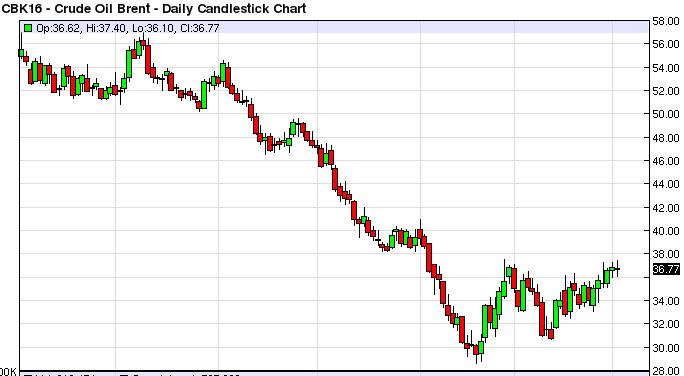

Brent

Brent markets went back and forth during the course of the session here on Wednesday, as we continue to see quite a bit of resistance at the $38 handle in this particular market. There is a significant amount resistance all the way from the $38 level on the bottom, and the $40 level as the top of that region. Ultimately, and exhaustive candle is what we are looking for in order to start selling. If we can break down below the $36 level, the market should continue to push lower as the market will target the $34 level, then the $32 level. Ultimately, this is a market that is very negative, and until we break above the $40 level it’s likely that this market will continue to sell and sell again.This longer-term downtrend should stay intact, because quite frankly there is much more out there that can push the market lower than bringing higher. Yes, there have been talks of production cuts lately, but at the end of the day US shale producers are all over this market as soon as it touches the $40 level.

Source: FXEMPIRE

Categories :

Tags : Brent Oil Oil News WTI Crude Oil