ECB meeting, key risk for the euro today – The ECB meeting today will be the main catalyst for the EURUSD, which could either send the Euro above 1.1217, for a corrective move to 1.138 or a break below 1.1143 which could see further declines start to pile up. Gold prices are trading near a key short term resistance level, but the correction to 1250 remains in play, while USDJPY extends its declines for a test of support near the 107 – 108 price level.

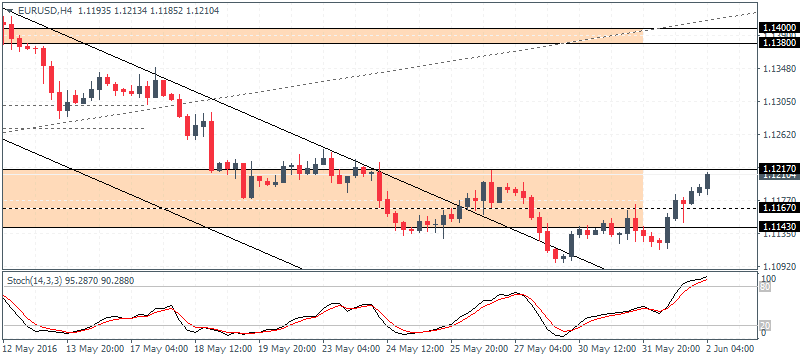

EURUSD Daily Analysis

EURUSD (1.121): EURUSD was bullish yesterday, closing at a two day high of 1.1188. Early Asian trading today is showing EURUSD trading near the 1.120 support/resistance with the 4-hour resistance at 1.12170. Price action is likely to remain range bound within 1.1217 – 1.1143 ahead of the ECB’s meeting later today. The bias to the upside opens up only on a daily close above 1.1217, for a move towards 1.138 resistance, while to the downside, below 1.1143, EURUSD could slide towards 1.10.

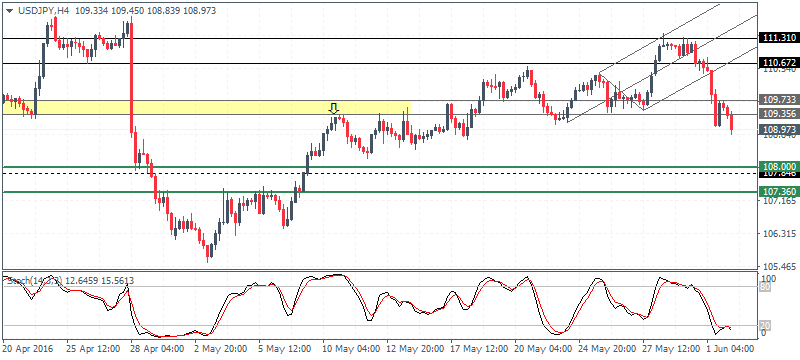

USDJPY Daily Analysis

USDJPY (108.9): USDJPY is posting a steady decline for the third consecutive day. Price action is currently trading at a 10-day low approaching the 108 support zone. On the 4-hour chart, the support level near 109.73 – 109.35 which managed to hold prices previously has given way leading to USDJPY declining. Support zone near 108 – 107.36 is a key price level to watch for a correction. Establishing support at this support zone could pave the way for a potential bullish move to the upside.

GBPUSD Daily Analysis

GBPUSD (1.442): GBPUSD extended its declines yesterday to test the 1.4425 support level. With the price now establishing a range near 1.4743 – 1.4425, GBPUSD could see flat price action in the near term unless one of the levels gives way. Below 1.4425, the next main level will be at 1.42. On the 4-hour chart, prices have cleared the 1.446 – 1.4445 support level. A pullback to establish resistance here will see a decline down to 1.4358 – 1.435 support level.

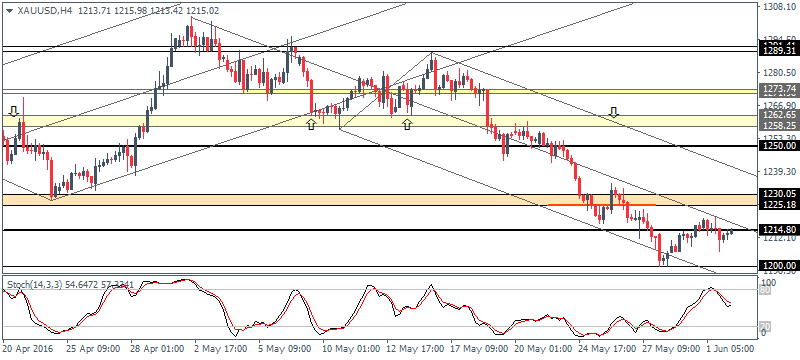

Gold Daily Analysis

XAUUSD (1215): Gold prices closed bearish yesterday after an attempt to rally off the 1200 level. Price action on the 4-hour chart shows gold back near the 1214.80 support/resistance level, with the next main resistance at 1225. In the near term, gold is likely to see a correction to 1250, provided prices can manage to close above the 1225 – 1230 support level which is now likely to act as resistance. To the downside, 1200 will be likely that it will be tested again.

Source: Orbex Forex Broker (Review and Forex Rebates Up to 85%)

Categories :

Tags : ECB's meeting forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf forex tutorials for beginners pdf how to trade forex for beginners pdf learning forex trading pdf Orbex Orbex Broker USD/JPY