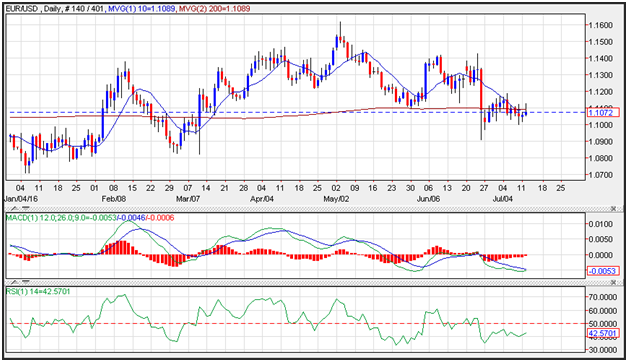

EUR/USD Analysis – The EUR/USD pair broke to the upside during the day on Tuesday, but turn right back around to form a bit of a shooting star. With this, I believe that the market will continue to favor selling opportunities on short-term moves, and eventually we could break down below the 1.10 level, because the larger term consolidation area between the 1.15 level and the 1.05 level below continues to drive the market overall. I do believe that this market will continue to face quite a bit of bearish pressure as there is a lot of uncertainty in the European Union at the moment.

EUR/USD Chart

The EUR/USD rebounded on Tuesday, but was unable to hold up above elevated levels as riskier assets benefited from the Abe victory over the weekend. The accelerated growth projected bythe European Economic Institute failed to keep prices buoyed. The exchange rate ran into resistance which near the 200-day moving average at 1.1089. Support is seen near the June lows near 1.09. Momentum is poised to turn positive as the MACD (moving average convergence divergence) index is about to generate a buy signal.

EUR/USD Chart

Source: FXEMPIRE

EUR/USD Intraday: under pressure.

Pivot: 1.1070

Most Likely Scenario: short positions below 1.1070 with targets @ 1.1035 & 1.1015 in extension.

Alternative scenario: above 1.1070 look for further upside with 1.1105 & 1.1125 as targets.

Comment: technically the RSI is below its neutrality area at 50.

Categories :

Tags : EUR/USD pair European Economic eurusd analysis MACD moving average convergence divergence