EURUSD goes nowhere but mind the inside bar – The dollar crosses were fairly flat yesterday with the sterling being the exception. While EURUSD formed a doji the day before, prices remained range bound in yesterday’s trading forming an inside bar which portends a breakout in the near term. Gold prices also stayed flat yesterday after testing intraday lows of 1234.95.

EURUSD Daily Analysis

EURUSD (1.136): EURUSD is trading within a range from Monday’s price action, and the inside bar could trigger a near term directional bias set in. To the upside, a breakout above Monday’s high at 1.1392 could trigger further upside towards the next main resistance at 1.147 while to the downside, a breakout below 1.1325 could see EURUSD slide towards 1.130 immediate support followed by 1.120. The Stochastics on the 4-hour chart is currently trending lower after reaching the overbought levels and could signal a near term correction to the downside.

USDJPY Daily Analysis

USDJPY (107.0): USDJPY is seen trending lower earlier today after prices failed to break above 108.0 minor resistance. However, the daily chart shows the Stochastics pointing to a bullish divergence which could see a potential break to the upside. Failure to close above 108 could see USDJPY fall back towards 2nd May lows of 106.14. On the 4-hour chart, 107.36 will be the first hurdle that needs to be cleared in order for USDJPY to eventually move towards 108.

GBPUSD Daily Analysis

GBPUSD (1.455): GBPUSD closed bullish yesterday after prices established support at 1.44250. Further upside is expected only on a conclusive break above 1.4635 followed by 1.4743. On the 4-hour chart, the price action volatility is clearly seen with GBPUSD trading within the larger range below 1.4647 and above 1.4358.

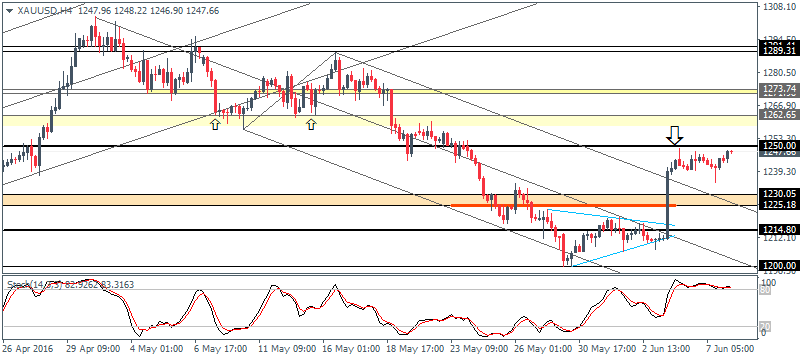

Gold Daily Analysis

XAUUSD (1247): Gold prices are looking to push higher follow two consecutive days of trading flat. The 1250 handle will be likely holding price rallies to the upside, but the hidden bearish divergence on the 4-hour chart signals a potential correction to 1230 – 1225 levels. In the near term, gold could remain range bound, but the further upside is expected only on a conclusive close above the 1250 handle if prices fail to pullback to establish support at 1230 – 1225.

Source: Orbex Forex Broker (Review and Forex Rebates Up to 85%)

Categories :

Tags : forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf forex tutorials for beginners pdf how to trade forex for beginners pdf learning forex trading pdf