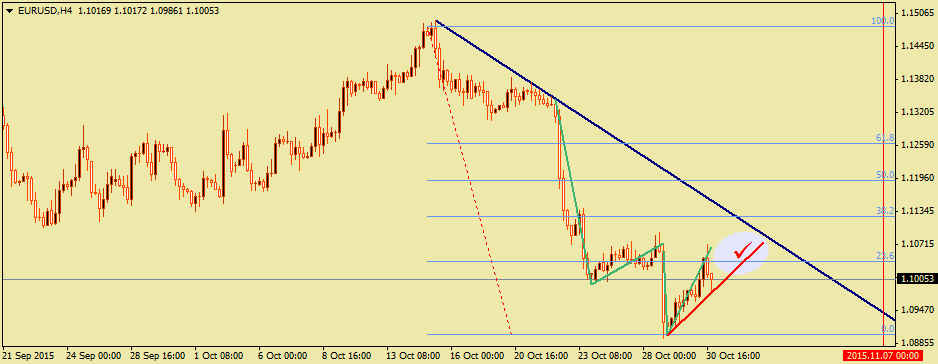

Last Week EURUSD try to go up but as my forecast it was weak up trend after the US interest rate it fall down but it goes up slowly again.

It’s probably that EURUSD continue slow uptrend till 1.1134 but it seems that we are in down trend yet.

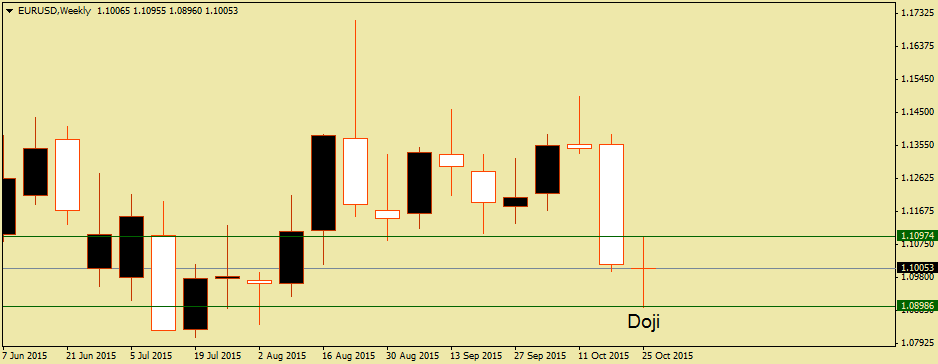

EURUSD Candlesticks:

Last week candle was Doji it means that buyer and seller was not successful! But sellers have a better record on 2 previous weeks it can be a notice for sellers anyhow Doji candle means we should see more movement in the next week and 2 weeks ago we had long bearish candle it can tell us the market is in down trend yet.

EURO and US Dollar Forex Economic Indicators:

| News | Currency | Impact |

| German Ifo Business Climate | EUR | — |

| Core Durable Goods Orders m/m | USD | Against US |

| CB Consumer Confidence | USD | Against US |

| Federal Funds Rate | USD | — |

| Advance GDP q/q | USD | Against US |

| Unemployment Claims | USD | — |

| German Retail Sales m/m | EUR | Against EUR |

| Employment Cost Index q/q | USD | — |

As you can see last week we had a lot of economic indicators against US so the only good news for US was Funds rate because it did not changed it was good for US Dollar.

Next week we have the most important monthly news on US Dollar I means Non-Farm Employment Change.

Conclusion:

Technical analysis shows we will have bearish trend on EURUSD but economic calendars are against US but they are and the other news is not positive for EUR! It means that we should see down trend in the next week till Friday!

My recommendation is last previous week look sell opportunity in the next week till Friday on Friday you can rest and wait to see what will happen!

Author: Mohsen J. From PipSafe Team

www.pipsafe.com

Categories :

Tags : eur EUR/USD EUR/USD News EURO forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf forex tutorials for beginners pdf how to trade forex for beginners pdf learning forex trading pdf