Forex Analysis – German Buba President Weidmann spoke about the Bundesbank’s Annual Report, in Frankfurt, with the following comments made: policy normalisation will take a long time and if the economic upswing continues and prices rise, there is no reason to not end QE this year. He said it is important to “gradually and dependably” reduce ECB stimulus. Rapid Eurozone growth confirms that inflation will move towards the target.

There is evidence that FX movements are having a smaller impact on inflation than in the past. Germany’s and the Eurozone’s growth was “very satisfactory”. He also said that bigger QE reduction or a clearer end date would be justifiable. Finally, he said that an ECB rate hike in 2019 is ‘not completely unrealistic’.

Eurozone Industrial Confidence (Feb) was as expected at 8.0, from a prior number of 8.8, which was revised up to 9.0. Economic Sentiment Indicator (Feb) was 114.1 v an expected 114.0, from 114.7 previously, which was revised up to 114.9. Business Climate (Feb) was as expected at 1.48, from 1.54 previously, which was revised up to 1.56. Consumer Confidence (Feb) was as expected at 0.1, from 0.1 prior, which was revised up to 1.4. Services Sentiment (Feb) was 17.5 v an expected 16.3, from 16.7 prior, which was revised up to 16.8. EURUSD traded between 1.23374 and 1.23245 after the release of this data.

German Harmonised Index of Consumer Prices (YoY) (Feb) was 1.2% v an expected 1.3%, from 1.4% previously.

The US Fed’s Powell testified on the Semi-annual Monetary Policy Report before the House Financial Services Committee, in Washington DC, in his new capacity as Chairman. Some of his comments were: He sees further gradual rate hikes and the outlook remains strong. Some headwinds facing the US economy are now tailwinds. Financial conditions are accommodative despite volatility and the Fed must strike a balance to avoid overheating and to lift inflation.

The FOMC sees risks roughly balanced and is monitoring inflation. Wages should increase at a faster pace and the US economic outlook is strong, with inflation to rise to 2%. The recent wage increases likely have been dampened by weak productivity growth. Last year’s business investments should begin to lift productivity. A robust jobs market is expected to support income and spending.

US Durable Goods Orders Ex-Transportation was -0.3% v an expected 0.4%, from -0.7% previously, which was revised up from 0.6%. Durable Goods Orders (Dec) was -3.7% v an expected -2.2%, from 2.6% previously, which was revised down from 2.9%. USDCAD traded between 1.27320 and 1.27072 after the release of this data.

US S&P/Case-Shiller Home Price Indices (YoY) (Dec) was as expected at 6.3, from 6.4% previously. House Price Index (MoM) (Dec) was 0.3% v an expected 0.4%, from 0.4% previously, which was revised up to 0.5%.

Japanese Large Retailer’s Sales (Jan) was 0.5% v an expected 0.4%, from 1.1% prior. Retail Trade s.a. (MoM) (Jan) was -1.8% v an expected -0.6%, from 0.9% prior. Retail Trade (YoY) (Jan) was 1.6% v an expected 2.1%, from 3.6% previously. Upon the release of this data, USDJPY moved to a high of 107.521 from 107.418 but then retraced the move within 30 minutes.

UK Gfk Consumer Confidence (Feb) was released earlier this morning, coming out at -10, in line with the consensus, and down from the prior reading of -9.

Chinese Non-manufacturing PMI (Feb) was released at 54.4 against a consensus of 55.0, from 55.3 previously.

EURUSD is up 0.04% overnight, trading around 1.23369.

USDJPY is down -0.27% in early session trading at around 107.035.

GBPUSD is up 0.07% this morning, trading around 1.39139.

Gold is unchanged in early morning trading at around $1,318.82.

WTI is down -0.22% this morning, trading around $62.68.

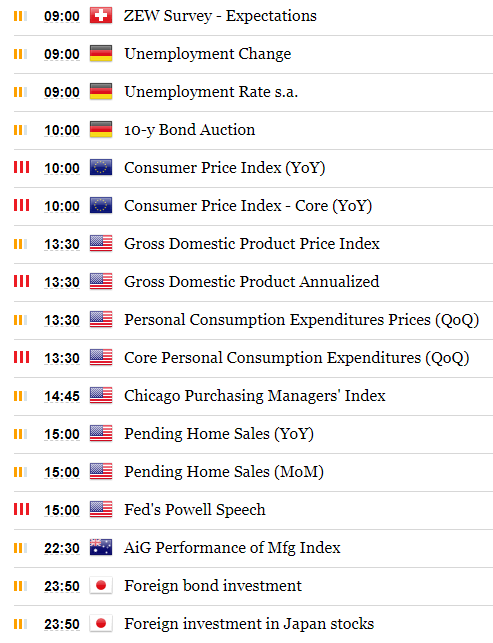

Major data releases for today:

At 08:00 GMT, Swiss KOF Leading Indicator (Feb) is expected to be 106.1 against 106.9 previously.

At 09:00 GMT, German Unemployment Change (Feb) is expected to be -15K from -25K previously. Unemployment Rate s.a. (Feb) is expected to be unchanged at 5.4%. EUR crosses could be affected by this data.

At 09:00 GMT, Swiss ZEW Survey – Expectations (Feb) data will be released with a previous value of 34.5.

At 10:00 GMT, Eurozone Consumer Price Index – Core (YoY) (Feb) is expected to be 1.1% from 1.0% prior. Consumer Price Index (YoY) (Feb) is expected to be 1.2% against 1.3% previously. EUR pairs may be moved by this release.

At 13:30 GMT, US Gross Domestic Product Annualized (Q4) is expected to be 2.5% from 2.6% previously. Gross Domestic Product Price Index (Q4) is expected to be unchanged at 2.4%. Personal Consumption Expenditures Prices (QoQ) (Q4) is expected to come in at 2.8% from 1.5% previously. Core Personal Consumption Expenditures Prices (QoQ) (Q4) is expected to be 1.9% from 1.3% previously. USD crosses may be heavily traded as a result of this data.

At 14:45 GMT, US Chicago Purchasing Managers’ Index (Feb) is expected to be 64.2 against a prior read of 65.7.

At 15:00 GMT, Pending Home Sales (YoY) (Jan) is expected to be -0.2% against a prior reading of -1.8%. Pending Home Sales (MoM) (Dec) is expected to be 0.3% against a prior reading of 0.5%.

At 15:00 GMT, US Fed’s Powell is due to testify on the Semi-annual Monetary Policy Report before the House Financial Services Committee, in Washington DC, in his new capacity as Chairman.

At 13:30 GMT, US Durable Goods Orders Ex-Transportation is expected to come in at 0.4% from -0.7% previously, which was revised up from 0.6%. Durable Goods Orders (Dec) is expected at -2.2% v 2.8% previously, which was revised down from 2.9%. USD crosses may be heavily traded as a result of this data.

At 22:30 GMT, Australian AIG Manufacturing Index is expected to be released with a previous value of 58.7. AUD crosses may be heavily traded as a result of this data.

At 23:50 GMT, Foreign Investment in Japanese Stocks (Feb 23) is expected to be in the region of the previous number of ¥-127.1B. Foreign Bond Investment (Feb 23) was ¥-553.1B previously. The report is released by the Ministry of Finance, detailing the flows from the public sector excluding the Bank of Japan. The net data shows the difference of capital inflow and outflow. A positive difference indicates net sales of foreign securities by residents (capital inflow), and a negative difference indicates net purchases of foreign securities by residents (capital outflow).

Today’s important market news -Forex News

Source:Fxpro Broker

Open a real account and receive 4.25$ the Forex Cashback

Categories :

Tags : Forex Analysis