Forex Analysis (Yen,AUD,BOJ and RBA decisions) – The Bank of Japan left its monetary policy unchanged, keeping interest rates at -0.10% as widely expected, although the central bank revised its inflation forecasts. The yen was muted in its reaction to the news. Meanwhile, the RBA was also seen holding rates steady which was also expected. The central bank linked future policy outlook to being data dependent while remaining hopeful that inflation has bottomed. With the start of a new trading month, the economic calendar is busy today.

EURUSD Daily Analysis (EUR/USD News and Technical Analysis)

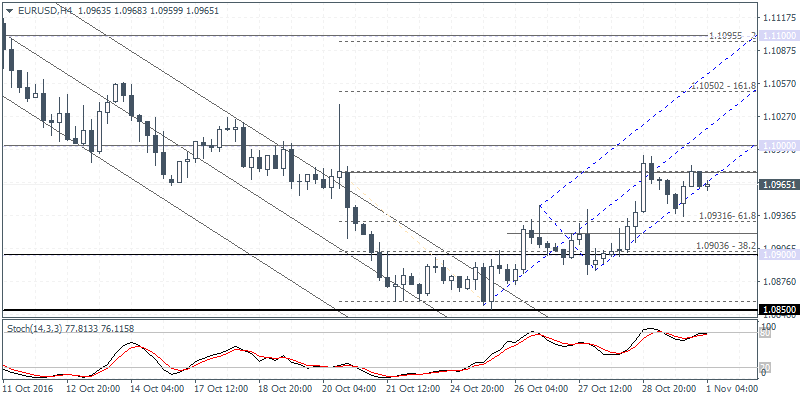

EURUSD (1.0966): The single currency was seen trading volatile yesterday after a brief dip to intraday lows near 1.0935 before recovering to close the day at 1.0976. Price action has stalled below 1.1000 – 1.0965 level of resistance and with the rising median line plotted on the chart, there is scope for the euro to slide back towards 1.0931 – 1.0903 support if the single currency fails to rally above 1.1000.

The bullish bias is retained as long as the support zone of 1.0931 – 1.0903 holds out. In the case of a breakdown of prices below this support, further declines could be seen with EURUSD likely to test 1.0850.

EUR/USD Intraday: the bias remains bullish.

Pivot: 1.0935

Our preference: long positions above 1.0935 with targets at 1.0995 & 1.1020 in extension.

Alternative scenario: below 1.0935 look for further downside with 1.0900 & 1.0880 as targets.

Comment: even though a continuation of the consolidation cannot be ruled out, its extent should be limited.

USDJPY Daily Analysis (USD/JPY News and Technical Analysis)

USDJPY (104.83): The US dollar closed bullish yesterday, but price action is starting to be biased to the downside. The 4-hour chart shows the doji candlestick patterns formed near the resistance level of 105.16 – 105.00 followed by a bearish close lower. A breakdown from the triangle pattern could, therefore, signify further weakness in the dollar which could send prices testing 104.00yen. Overall, the upside momentum is starting to look weaker but needs confirmation from the breakout from the lower trend line of the triangle pattern.

AUDUSD Daily Analysis (AUD/USD News and Technical Analysis)

AUDUSD (0.7652): The Australian dollar rallied to the previous resistance level of 0.7648 earlier today on the RBA’s decision to hold rates steady. The rally off the lower support near 0.7580 shows a retest off not just the resistance level but also the breakout from the rising median line.

This could signal a near term decline to the downside if price fails to break out above 0.7648 on a daily session. In the near term, AUDUSD could remain range bound within 0.7648 resistance and 0.7580 support with a breakout from either of these levels providing room for further gains or declines.

AUD/USD Intraday: the upside prevails.

Pivot: 0.7595

Our preference: long positions above 0.7595 with targets at 0.7680 & 0.7705 in extension.

Alternative scenario: below 0.7595 look for further downside with 0.7565 & 0.7525 as targets.

Comment: the RSI advocates for further advance.

Source: Orbex Forex Broker -Review and Forex Rebates

Categories :

Tags : AUD/USD News and Technical Analysis doji candlestick patterns EURUSD News and Technical Analysis Forex Market Analysis Orbex Forex Broker -Review and Forex Rebates USDJPY News and Technical Analysis