Source: Fxprimus Forex Broker(Review and Forex Cashback up to 85%)

today’s important economic events

Upcoming indicators/events for Wednesday December 23 (GMT):

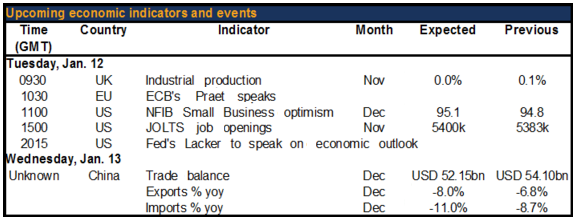

Tuesday, Jan. 12

0930 UK – Industrial production (Nov)

Manufacturing output fell mom in October but industrial output rose slightly. The pattern may be reversed in November, as a drop in oil and gas output could dampen overall IP. That would tend to be negative for GBP.

Wednesday, Jan. 13

N.A. China – Trade data (Dec)

The market looks for the fall in both imports and exports to accelerate, which would be negative for commodity producers and other countries exporting to China. Further volatility in global equity markets could be a result.

Can Excel’s “Rand()” Function Outperform the Pundits?

Last Thursday, I presented the results of my annual review of how well the pundits did in forecasting FX rates for 2015. If you remember, the collective wisdom of the market was pretty useless – basically no different from a coin toss for both spot market return (a 55% hit ratio) and total return (43%).

So here’s the question: can Excel’s RAND() function, which produces random numbers, do as well as the combined wisdom of all this intellectual firepower? If so, it might save corporate treasurers a lot of money. Basically all they would need to do their forecasting would be a €2 coin. Cheap ones could get away with a €1coin. In the US, 25¢ would do.

I made a spreadsheet that uses the RAND() function to generate random numbers, then test to see whether those numbers are odd or even. If they’re odd, then I say the currency will be down against the dollar; if even, then up.

Of course, it’s possible that the market gets the dollar call wrong, but gets other calls right. So I did the same exercise for the euro.

Just to be fair, I’m using the end-2015 rate for each currency as the starting point.

OK, time to hit the “calculate” button!

The market is distinctly bullish USD: it sees only six currencies gaining vs USD this year (GBP, CAD, MXN, NOK, RUB and ZAR). Apparently the pundits assume that oil prices will recover by the end of the year. The Random Generator on the other hand is, well, random; it predicts 15 of the currencies will be up vs USD and 16 will be down, so pretty much a 50-50 split.

For the euro we have an even bigger divergence. The pundits are also relatively bullish EUR; they expect only eight currencies to gain vs EUR (again, mostly the oil currencies) and see 22 falling. On the contrary, the Random Generator is a EUR bear – it predicts 19 currencies will gain vs EUR and only 11 will fall. Probably the market thinks the ECB has finished loosening and by the end of the year will start to talk about tapering off its QE program, which would support the euro. The Random Generator though…who knows what it’s thinking?

So who is going to be right? Tune in this time next year – and hope that I can remember where I stored this file!

Categories :

Tags : forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf Forex News forex tutorials for beginners pdf FxPrimus broker how to trade forex for beginners pdf learning forex trading pdf