Forex Markets Are Calm as they Wait for New Fed Chairman Powell – The ECB’s Coeure spoke in Frankfurt at a working group meeting regarding euro risk-free rates. He said that a reform of reference interest rate will help to underpin good functioning euro area money markets and trust in its related products. He also added that it is vital since monetary policy is initially transmitted through financial markets.

The US Fed’s Bullard made a scheduled speech from Washington with the following comments: The natural rate of interest is low and not likely to change, and the Fed guidance ought to describe a relatively flat rate path. Substantial Fed hikes risk making policy too tight, and weak productivity is one factor holding down natural rate of unemployment. It’s a good idea to periodically review inflation framework but it would require a ‘buy-in’ from the political and financial community.

High demand for safe assets is a global issue. Proponents of changing framework would have to prove it would add benefits. The rise in 10-year rates is partially driven by the rise in inflation expectations among investors. He says he’s sceptical that 10-year yields will break out from here and inflation expectations have moved up some.

US Chicago Fed National Activity Index (Jan) was 0.12 v an expected 0.15, from a previous 0.27, with EURUSD moving lower from 1.23228 to a low of 1.23016.

ECB President Marion Draghi testified on monetary policy and the inflation outlook before the European Parliament Economic and Monetary Affairs Committee in Brussels. His comments were: Growth is stronger than previously expected and the Eurozone economy is expanding robustly. At the same time, inflation has yet to show more convincing signs of a sustained upward adjustment. Given the uncertainty surrounding the measure of economic slack, the true number might be larger than estimated.

We anticipate that headline inflation will resume its gradual upward adjustment. The Labour market is expected to improve further. The relationship between growth and inflation remains largely intact, even if it was temporarily weakened. ECB guidance on interest rates is ‘very important’ and US Tax Reform will reshape the global Tax landscape.

US New Home Sales (MoM) (Jan) was 0.593M v an expected 0.645M, from 0.625M previously, which was revised up to 0.643M. New Home Sales Change (MoM) (Jan) was -7.8% v an expected 3.2%, from -9.3% previously, which was revised up to -7.6%. EURUSD sold off from 1.23033 to 1.22862 as a result of this data.

US Dallas Fed Manufacturing Business Index (Feb) was 37.2 v an expected 28.4, from 33.4 previously.

US FOMC Member Quarles delivered a speech titled “An Assessment of the US Economy” at the National Association of Business Economics Policy Conference, in Washington DC. Audience questions followed and some of the comments made were: “With my current economic outlook, I anticipate that further gradual increases in the policy rate will be appropriate to both sustain a healthy labor market and stabilize inflation around our 2 percent objective”. He also said that “Some of the factors that have been holding back growth in recent years could shift, moving the economy onto a higher growth trajectory” and “I currently see this shift more as a clear possibility than an unarguable reality.”

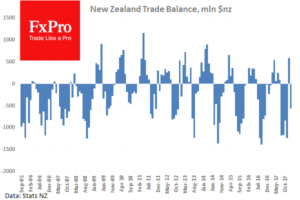

New Zealand Trade Balance (MoM) (Jan) numbers were released at $-566M and were expected to be $-2710M. The prior number was $640M, which was revised up to $596M. Imports (Jan) were $4.87B v an expected $4.60B, from $4.91B previously, which was revised down to $4.89B. Trade Balance (YoY) (Jan) was $-3.220B v an expected $-2.711B, from $-2.840B previously, which was revised down to $-2.880B. Exports (Jan) were $4.31B against an expected $4.58B, from $5.55B previously, which was revised down to $5.49B. AUDNZD moved higher from 1.07364 to 1.07847 after this data release.

EURUSD is up 0.05% overnight, trading around 1.23236.

USDJPY is down -0.03% in early session trading at around 106.870.

GBPUSD is unchanged this morning trading around 1.39632.

Gold is unchanged in early morning trading at around $1,332.92.

WTI is down -0.28% this morning, trading around $63.81.

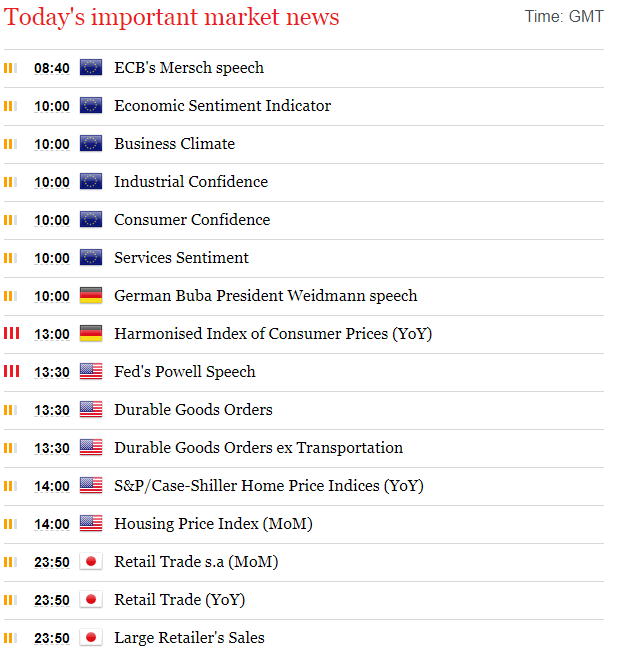

Major data releases for today:

At 08:40 GMT, ECB’s Mersch is due to give a prepared speech, with comments made having the potential to move EUR crosses.

At 10:00 GMT, German Buba President Weidmann is due to speak about the Bundesbank’s Annual Report, in Frankfurt, with comments made having the potential to move EUR crosses.

At 10:00 GMT, Eurozone Industrial Confidence (Feb) is expected to be unchanged at 8.0. Economic Sentiment Indicator (Feb) is expected at 114.0 from 114.7 previously. Business Climate (Feb) is expected at 1.48 from 1.54 previously. Consumer Confidence (Feb) is expected to be unchanged at 0.1. Services Sentiment (Feb) is expected to be 16.3 from 16.7 prior. EUR pairs could be affected by this data.

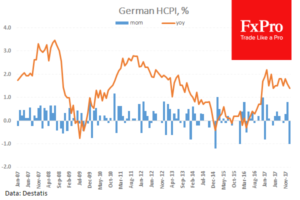

At 13:00 GMT, German Harmonised Index of Consumer Prices (YoY) (Feb) is expected to be 1.3% from 1.4% previously.

At 13:30 GMT, US Fed’s Powell is due to testify on the Semi-annual Monetary Policy Report before the House Financial Services Committee, in Washington DC, in his new capacity as Chairman.

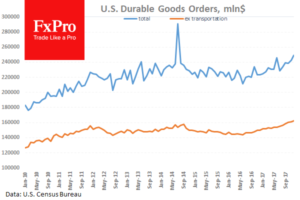

At 13:30 GMT, US Durable Goods Orders Ex-Transportation is expected to come in at 0.4% from -0.7% previously, which was revised up from 0.6%. Durable Goods Orders (Dec) is expected at -2.2% v 2.8% previously, which was revised down from 2.9%. USD crosses may be heavily traded as a result of this data.

At 15:00 GMT, US S&P/Case-Shiller Home Price Indices (YoY) (Dec) is expected to come in at 6.3% from 6.4% previously. House Price Index (MoM) (Dec) is expected unchanged at 0.4%. USD crosses may be heavily traded as a result of this data.

At 21:45 GMT, Japanese Large Retailer’s Sales (Jan) is expected to be 0.4% from 1.1% prior. Retail Trade s.a. (MoM) (Jan) is expected to be -0.6% from 0.9% prior. Retail Trade (YoY) (Jan) is expected to be 2.1% from 3.6% previously. This data could affect JPY crosses.

Source:Fxpro Broker

Open a real account and receive 4.25$ the Forex Rebates

Categories :

Tags : forex markets