[text]

Forex Brokers News – Source: IFC Markets

GeWorko method from IFC Markets

PCI GeWorko – portfolio approach to trading

GeWorko method from IFC Markets (GeWorko model) – is a method of synthetic financial instruments composition, based on elementary assets: currency pairs, equities, commodity futures, etc. The essence of this method is an expression of a basic asset/portfolio value through the quoted asset/portfolio value on the basis of their quotient. The GeWorko method expands a Forex cross rate model to arbitrary assets and asset portfolios.

The GeWorko model expresses an individual approach of investor to the analysis of financial markets. It allows comparing the values of portfolios and forecasting of industries or economical sectors relative development on the basis of an individual approach to market analysis. Personal Composite Instrument (PCI) is a product of GeWorko model realization.

Personal Composite Instrument (PCI) – is a class of synthetic financial instruments, formed by expression of the base investment portfolio in the units of the quoted portfolio. In the simplest case, the value of two different assets, for example GOOGLE and APPLE, corresponds to the numerator and denominator. Trading operations with the PCI are realized in the following way – let us consider BUY operation as an example:

• Definition of the bought asset’s volume – base part of the PCI;

• Determination of the quoted part’s volume through the PCI rate;

• The sale of the necessary volume of the quoted part and the purchase of the base asset.

PCI SELL operation is realized in the similar way. Like for any synthetic instrument, the goal of composing a PCI is optimization of investment characteristics, such as yield/risk ratio, forecast horizon, analytical volume of information, and many more. Optimization is realized in comparison to all available standard trading instruments. Let us consider the example of market situation, where comparative fundamental analysis of two companies may become less controversial than the estimation of investment characteristics of a single company in the global market. In more general case of PCI construction, portfolios with required investment characteristics are used instead of a base and quoted assets.

PCI possesses calculated historical quotes, and is considered to be a unit of BUY/SELL operations in accordance with the selected operational volume. A set of possible trading strategies based on PCI includes, but is not limited to pairs trade, spread trading and portfolio investment. Composition and structure of a personal composite instrument are defined by investor via NetTradeX trading platform.

YouTube Channel: https://www.youtube.com/user/Geworko/feed

Example #1: FCATTLE/SOYB, WHEAT/F-CATTLE

The use of soybean as a meat substitute may suggest an inverse relation between the demands for these products. 13 days correlation reached – 98% by 12 of June 2014 which proves this idea. Another pair of competitors is based on two agricultural futures: frozen cattle and wheat. The chart below is composed in NetTradeX trading platform and demonstrates accelerating trend motion since the beginning of September. The continuous futures CFD’s have been used.

Example #2: GOOGLE/APPLE

Another example spread instrument, based on two competitors in high-tech industry. Comparing quarterly data (Q4, 2014) and forecasts for Google and Apple, we assume that the development of Google will go faster. Financial indicators of Google continue to outpace the Apple performance at a comparable profitability level for both companies. We believe that the main positive factor for the Google quotations has been the increase of revenues by 40% over one year and by 38.66 % for the 4th quarter. This fundamental effect is represented at the PCI D1 chart, composed in NetTradeX.

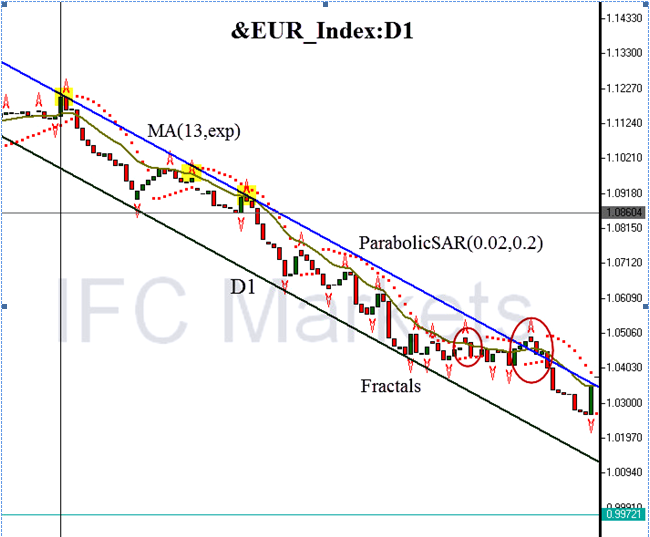

Example #3: EUR Index

The currency index is used for the analysis and trade of the main European currency EUR against the portfolio USD(4.35%)+JPY(18.2%)+GBP(18.8%)+AUD(19.8%)+CAD (19.65%).

Currency index advantages:

• The index reaction to Euro zone fundamental events is the most obvious and stable;

• The index forms a stable trend channel suitable for position trading;

• The index sensitivity to fundamental events in other currency zones is minimal.

This allows detecting low-volatility trend movement of the index that characterizes objectively the state of Euro zone. The vertical at the chart below line marks the ECB President Jean Claude Trichet’s speech at a Brussels press conference on December 3, 2009. Trichet announced that ECB was starting the gradual reductions of its commercial bank support programs. Furthermore, floating interest rates would be applied for those programs.

The announcement resulted in a fall in attractiveness of the European currency for foreign investors. The price of the PCI (Personal Composite Instrument) ended the sideways motion and formed a new downward trend channel, which confirms the weakening of the European currency. For the 85-day period of the trend channel existence the index yielded profitability equal to 6%. The trend channel width that characterizes volatility or risk, amounted to 1.8% of the starting price. We can estimate the position trading return by the profitability to risk ratio: 3.3 (>2). Thus Index is attractive enough for position trading.

[/text]

Categories :

Tags : ECB forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf forex tutorials for beginners pdf how to trade forex for beginners pdf IFC Markets learning forex trading pdf