[text]

Source: FxPro Forex Broker

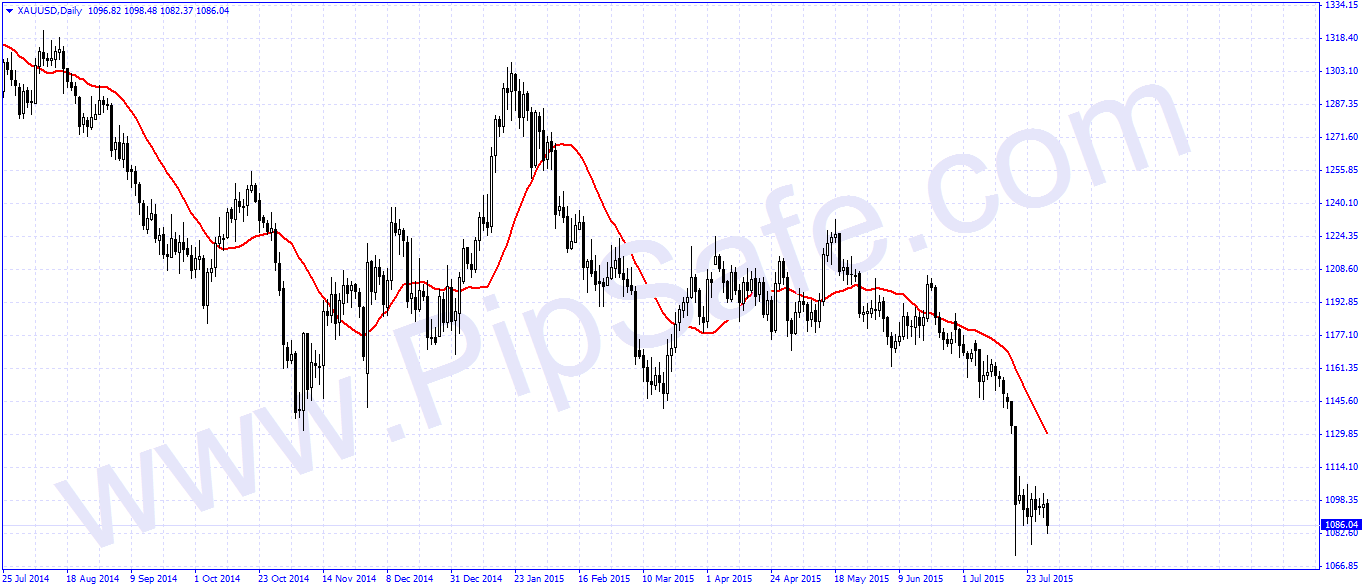

No doubt about which chart looks the most interesting at the start of this week and that’s gold. Leaving aside the reasons for this latest push lower, it has brought to an end the more recent period of consolidation for the dollar-based gold price that had given some hope for the bulls that the worst was over.

More nonsense is written about gold than nearly any other commodity. Because it strays into the realm of portfolio allocation, is non-yielding and is of limited industrial or commercial use, there is very little basis for valuing it. So this gives free rein to various talking heads to say pretty much whatever they want, which usually involves it going up. I remember attending a presentation in 2013 given by a technical analyst. His biggest call was long gold and he went on to say that more than 90% of his UK pension (having worked here for several years) was in gold. It’s like gold is an excuse to take leave of all the basics of investment and portfolio allocation. As well as losing 20% on gold, this guy has also lost out on the c. 30% rally in European equities and 15% (total return index) in European sovereign bonds.

Source: Fx Empire

Gold markets went back and forth during the course of the day on Wednesday, essentially sitting just below the $1100 handle. This is an area that we been hanging about some time now, and as a result we simply think that this is a market that’s probably best left alone. We could break above the $1100 level in rally, but at that point in time we believe it would only be a selling opportunity from higher levels. We believe that a resistive candle after a break out to the upside would be an excellent way to start selling this market again. On the other hand, we could break down to a fresh, new low, which also has us selling.

Gold Chart

[/text]

Categories :

Tags : forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf forex tutorials for beginners pdf Gold Gold Market Gold NEWS how to trade forex for beginners pdf learning forex trading pdf