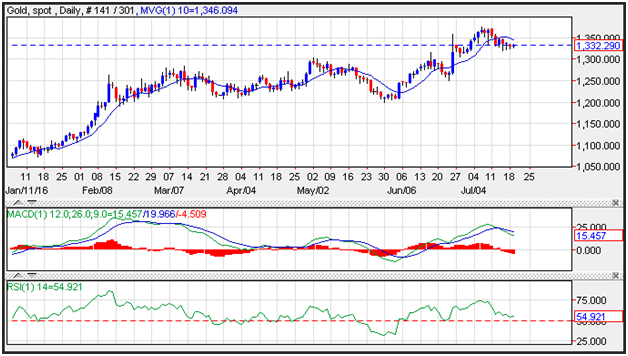

Gold Analysis – prices were steady near 1,332.00 per ounce, after ranging between 1,328.50 and 1,335. A firmer dollar has limited upside potential. A stronger than expected U.S. Housing Starts held the dollar gain traction. The gold market will be eying upcoming central bank meetings, where further easing could dent gold sentiment further.

The ECB is not expected to take further action at its Thursday meeting, though Draghi is likely to paint a dovish picture in his press conference. Japan meanwhile, is seen easing both monetary and fiscal policy, which will not do gold bulls any favors. Support is seen near the June lows at 1,250 while resistance is seen near the 10-day moving average at 1,346. Momentum is negative as the MACD (moving average convergence divergence) index recently generated a sell signal. This occurs as the spread (the 12-day moving average minus the 26-day moving average) crosses below the 9-day moving average of the spread.

Gold spot Intraday: under pressure.

Pivot: 1337.00

Our preference: short positions below 1337.00 with targets @ 1320.00 & 1312.00 in extension.

Alternative scenario: above 1337.00 look for further upside with 1342.00 & 1350.00 as targets.

Comment: the upward potential is likely to be limited by the resistance at 1337.00.

Source: FXEMPIRE

Categories :

Tags : ECB Gold Analysis Gold spot Intraday MACD moving average convergence divergence