Source:Vinson Financials Broker (Review and Forex Rebates Up to 85%)

During Asian session Trade Balance data from China came better than expected at 382 billion versus the forecast of 339 billion provide some support for further correction in the market. Additionally the USD-Denominated Trade Balance from China reported at 60.1 billion better than the expected 52.2 billion.

In Forex market the commodity currencies are trading higher since the oil recovered mildly. AUD, NZD and CAD have benefited the most last night along with the USD on the other hand CHF is so far the weakest one, followed by Euro and Yen. GBPUSD also recovered after the drop at the fresh lows of 1.4350 after the manufacturing data missed expectations and came in -0.4% vs 0.1%. In general most analyst expected that most majors pairs will continue to trade sideways.

From the economic releases we had the French CPI m/m at 0.2%. Later on today we have Eurozone Industrial Production m/m and German 10-y Bond Auction. SNB Governing Board Member Fritz Zurbrugg will speak also at 13:00 GMT. From US the Crude Oil Inventories are worth to be monitored as well.

View our full economic calendar for a daily roundup of major economic events.

Data releases to monitor:

EUR: Industrial Production m/m, German 10-y Bond Auction

CHF: SNB Member Zurbrugg Speaks

USD: Crude Oil Inventories

Trade Idea of the Day

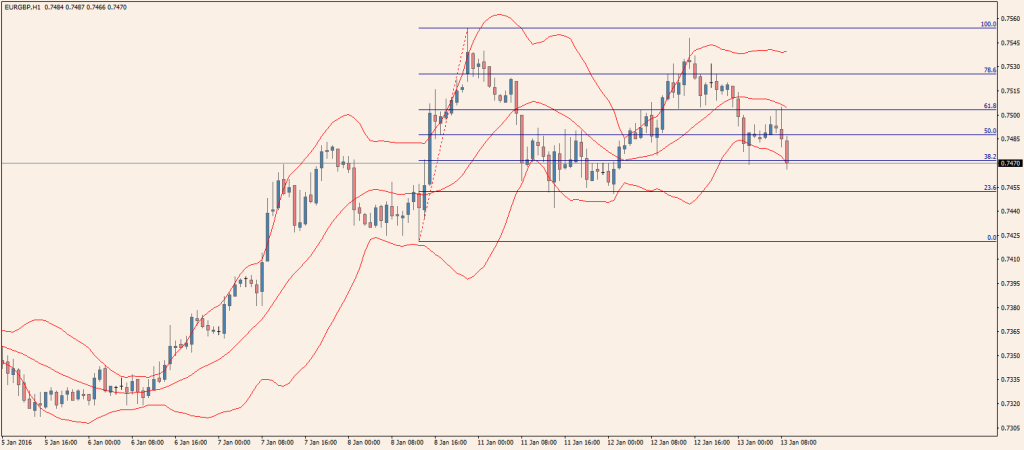

EUR/GBP

Currently the pair is trading at 0.7470. Traders must monitor the 0.7555 resistance level and the support level 0.7420 for possible breakouts. A possible scenario would be a further movement below the 0.7470 support level to 0.7455 level where a break may lead to testing the 0.7420 support. An alternative scenario could be a movement above the 0.7500, where a break may lead to the 0.7545 area.

EUR/GBP Chart

Categories :

Tags : forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf forex tutorials for beginners pdf how to trade forex for beginners pdf learning forex trading pdf