Source:Vinson Financials Broker (Review and Forex Rebates Up to 85%)

Traders saw the Brent crude dipped below 30 USD per barrel on Wednesday. That low was for the first time since April 2004, further to that speculation the Bank of Canada could cut interest rates as early as next week made the CAD pairs volatile.

Today traders are turning their focus to UK where the BOE is having the first policy review of the year. Analyst believe the BOE may leave the leave interest rates unchanged and any hint of hawkish opinion would strength the GBP.

In US the comments of Boston Fed President Eric Rosengren are worth mentioning. He said that the global and U.S. economic growth may be slipping and could force the Fed into a more gradual course of rate hikes than officials currently expect. This for sure is not helping dollar since another FED official express concerns about China.

Furthermore last night Australian employment dropped to -1k and Unemployment Rate remained unchanged at 5.8% both came in better than expected. Japan Core Machinery Orders m/m came in -14.4% m/m and PPI y/y -3.4% y/y in December. Also Japan Prelim Machine Tool Orders y/y came in at -25.8% y/y. Germany released WPI m/m at -0.8% and Italian Industrial Production m/m came in at -0.5%. US will release import price index and jobless claims. Canada will release new housing price index. Later tonight from New Zealand we have FPI m/m.

View our full economic calendar for a daily roundup of major economic events.

Data releases to monitor:

EUR: ECB Monetary Policy Meeting Accounts

GBP: MPC Official Bank Rate Votes, Monetary Policy Summary, Official Bank Rate, Asset Purchase Facility

CAD: NHPI m/m

USD: Unemployment Claims, Import Prices m/m, Natural Gas Storage

Trade Idea of the Day

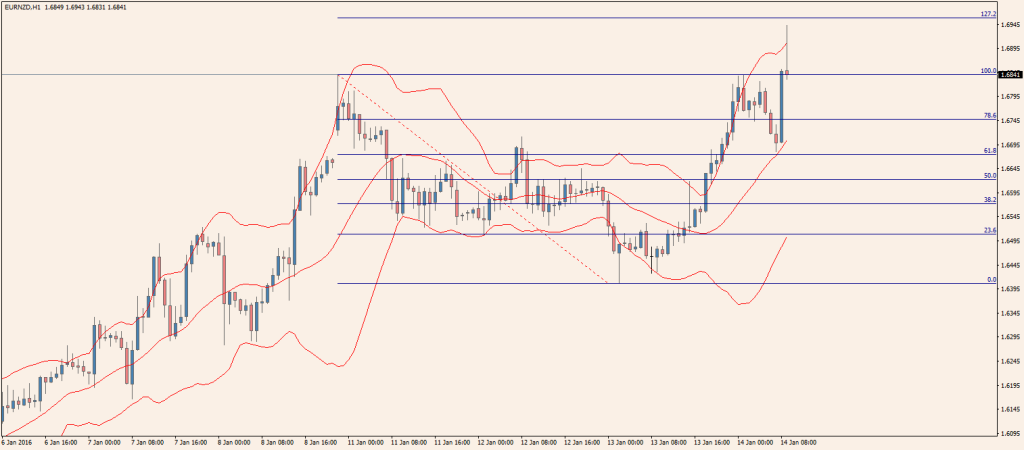

EUR/NZD

Currently the pair is trading at 1.6841. Traders must monitor the 1.7150 resistance level and the support level 1.6410 for possible breakouts. A possible scenario would be a further upwards movement near 1.6950 as long as the 1.6840 level holds. An alternative scenario would be a break of 1.6750 support with target the 1.6670 area.

Categories :

Tags : Forex forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf Forex News forex tutorials for beginners pdf how to trade forex for beginners pdf learning forex trading pdf