Market Review for January 21, 2016

Source: Vinson Financials Broker (Review and Forex Rebates Up to 85%)

ECB meeting day today and EUR and talks about ECB actions will dominate the markets. No one is expecting much from today’s ECB in regards the rate decision and most probably it will keep monetary policies unchanged. Nonetheless, the press conference later on must be closely monitor for any new comments or hints. In the past ECB officials suggested that the central bank will adopt a wait and see stance to see how the stimulus feeds through to the economy. Nonetheless when those comments where made the oil levels were different and China economy forecast better. For sure Draghi will comment the inflation expectations with the current oil prices and maybe the possibility of further stimulus.

Yesterday the BOC kept the overnight rate unchanged at 0.5%. The comments that the current stance of monetary policy is appropriate and the acknowledgement of the fact that the oil prices is a setback for the Canadian economy moved the CAD. Furthermore the BoC is projecting that the economy will grow by 1.25% in 2016 and 2.25% in 2017 therefore the USDCAD is now at 1.4490 area prior the 1.4690 high before the meeting.

Elsewhere we had the MI Inflation Expectations 3.6% and HIA New Home Sales m/m -2.7% from Australia. The RICS House Price Balance 50% from UK and from Japan the All Industries Activity m/m at -1.0%. Expected the ECB meeting the US Unemployment Claims is expected today at 279K while Philly Fed Manufacturing Index at -5.8.

View our full economic calendar for a daily roundup of major economic events.

Data releases to monitor:

EUR: Minimum Bid Rate, ECB Press Conference

USD: Philly Fed Manufacturing Index, Unemployment Claims

Trade Idea of the Day

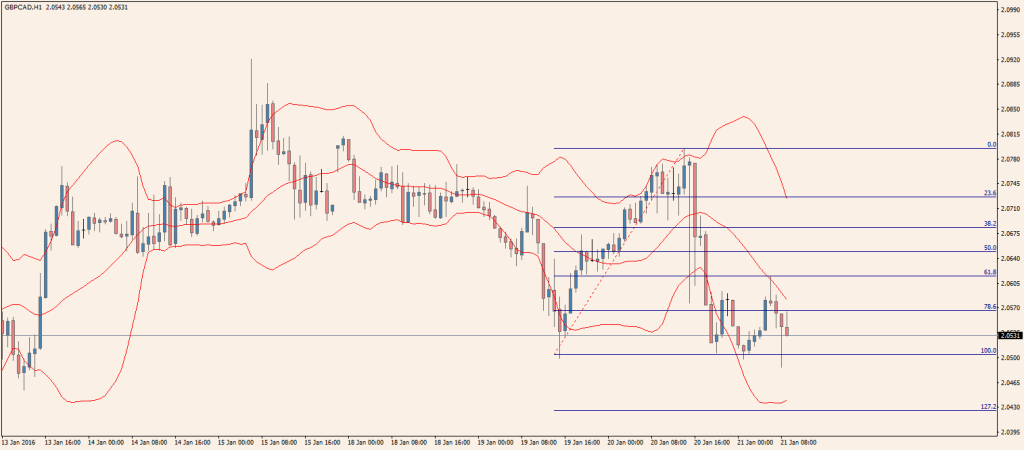

GBP/CAD

Currently the pair is trading at 2.0531. Traders must monitor the 2.0794 resistance level and the support level 2.0425 for possible breakouts. A possible scenario would be a further downwards movement and break of 2.0500 with target the 2.0470 area and possible the 2.0425. An alternative scenario would be a break of 2.0615 resistance with target the 2.0690 area.

Categories :

Tags : forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf Forex Market Analysis Forex News forex tutorials for beginners pdf how to trade forex for beginners pdf learning forex trading pdf