Markets await NFP – July’s nonfarm payrolls report will be the main calendar event to watch for today. A positive beat on expectations will most likely induce dollar buying putting the recent rally in USD crosses at the risk of a correction. Gold prices recovered their losses from the previous days and remain trading back near the 1365 handle, but poses a risk of a correction to the downside.

EURUSD Daily Analysis

EURUSD (1.1134): EURUSD closed at 1.1128 yesterday, just above the 1.110 support level. We expect the 1.110 support to be tested, and the downside will be limited until this level breaks convincingly. On the 4-hour chart following the fake upside breakout above 1.11972, EURUSD eventually closed below 1.11493 with the bias open for a test to 1.110 – 1.1076 support zone. Further declines can be expected below this support zone, in which case, 1.10 remains open for a retest of support.

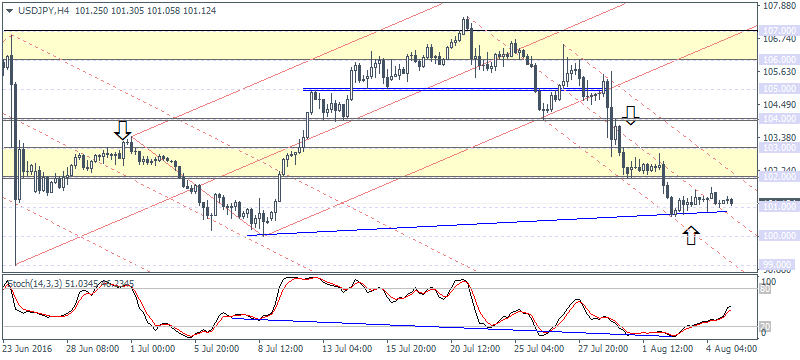

USDJPY Daily Analysis

USDJPY (101.12): USDJPY closed with a doji candlestick pattern yesterday which could either signal a near term correction to the upside or a continuation. The 100.00 psychological price level will be an important support to the downside, while 102 needs to give way as resistance in order for the dollar to extend gains towards 104. On the 4-hour chart following the fresh lows that were posted near 100.684, USDJPY bounced higher. A higher low near 101 could, however, signal an early change of the short-term trend. Still, watch for 102.00 which remain as a strong resistance.

GBPUSD Daily Analysis

GBPUSD (1.313): GBPUSD broke down below 1.32 yesterday with prices showing a minor recovery in early Asian trading today. But a daily bullish close will be required for confirmation. In the meantime, GBPUSD is forming a symmetrical triangle pattern near the current lows which indicates that price could either break down below 1.30 for a continuation of the downtrend, or an upside breakout above 1.34 which will see price correct towards 1.36 and 1.38 eventually. On the 4-hour chart, although the inverse head and shoulder is still in play, the pattern is looking increasingly weaker. A close below 1.30 will invalidate any bullish bias.

Gold Daily Analysis

Source: Orbex Forex Broker (Review and Forex CashBack Up to 85%)

Categories :

Tags : EURUSD Daily Analysis forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf forex tutorials for beginners pdf GBP/USD GBPUSD Daily Analysis Gold Daily Analysis how to trade forex for beginners pdf learning forex trading pdf nfp