NFP Report – The European Central Bank (ECB) as expected did not change its interest rate or made any modifications to its quantitative easing program. ECB president Mario Draghi left the door open for easing measures if European inflation remains below target. The central bank left their inflation forecast unchanged despite higher energy prices and will mark 6 years of below target inflation. The ECB forecasts were lower than anticipated and leaving them unchanged shows the ECB was not even trying to get the market on its side with analysts expecting more stimulus if the current batch did not move the central bank’s estimates.

The biggest indicator in forex, the U.S. non farm payrolls (NFP) will be released on Friday, June 3 at 8:30 am and followed by the ISM non-manufacturing PMI at 10:00 am EDT. The last NFP before the June FOMC meeting gains extra importance after the minutes from the April FOMC hinted that the Fed could hike rates if the U.S. economy showed signs of a rebound after a weak first quarter.

The ADP private payrolls released on Thursday rose 173,000 and an 10,000 jobs upward revision to the data in April. The U.S. telecommunication firm Verizon seven week strike did not affect private payrolls, but it expected to have a negative effect on the NFP which is expected on a range of 160,000 to 190,000 jobs but the Verizon strike effect could take as high as 39,000 jobs off the total. The service sector continues to drive the growth in employment as manufacturing shrinks. The NFP headline jobs number could underperform but still boost the probabilities of a rate hike in June if the wage component grows.

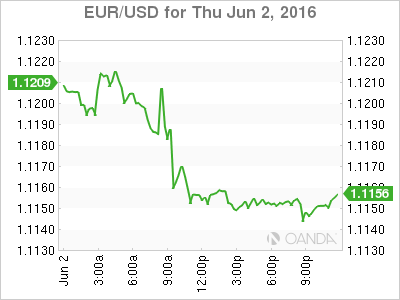

The EUR/USD depreciated 0.249 percent in the last 24 hours. The pair is trading at 1.1157 ahead of the release of the U.S. NFP. The pair changed from an EUR focus as the ECB statement and press conference unfolded, and then took a turn to concentrate on the USD ahead of the NFP report and its potential impact on the June rate hike. The Verizon strike is the hardest obstacle facing a positive NFP report, but signs of positive inflation of U.S. worker’s wages could validate to the market that the Fed will move in June.

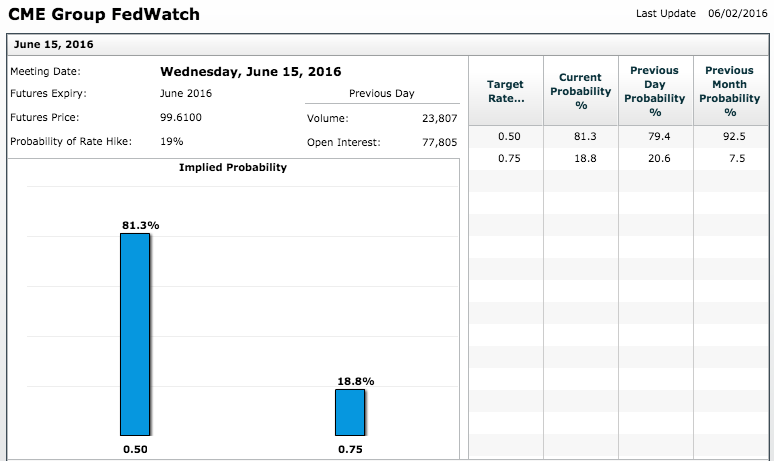

The CME Group Fedwatch tool is showing a 18.8 percent probability of a rate hike in June. The lower employment report expectations have reduced a June hike, but lets remember that before the release of the April FOMC minutes the number was in the single digits after a dovish statement. June still presents a good opportunity for the U.S. Federal Reserve to move on interest rates.

he U.S. economy is growing, not at a breakneck speed, but it is moving in a positive direction. July is a close candidate for a rate hike, with the CME FedWatch pointing to a 59 percent rate hike probability and the added benefit of being able to have the Brexit outcome be already known as opposed of changing monetary policy in an uncertain environment. The U.S. Federal Reserve has said that they don’t need to wait for a FOMC meeting with a press conference to hike rates, although in reality it is preferred given that they can dispel any doubts about the message of the statement and their actions. Remember the April FOMC? June and July have a compelling argument, but September starts to get a little complicated due to the U.S. presidential elections.

Source: http://www.marketpulse.com/

Categories :

Tags : CME Group FOMC forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf Forex Market Analysis forex tutorials for beginners pdf how to trade forex for beginners pdf learning forex trading pdf NFP report usd