On Tuesday, North Korea fired a missile that flew over Japan and landed in the Pacific Ocean, approximately 1,180 kilometers (735 miles) off the northern region of Hokkaido, in a sharp escalation of tensions on the Korean peninsula. The implications of a missile flying over Japan are likely to be severe with condemnation expected from the UN and the US. With tensions rising again, USD was sold and the market sought safe havens.

On Monday, crude oil prices dropped as flooding from Tropical Storm Harvey inundated refining centers along the Texas coast, shutting more than 10% of US fuel-making capacity. The financial cost of Harvey is likely to be considerable, with analysts predicting costs in excess of $25 Billion, but the markets are aware it will take considerable time before the true impact is calculated. Regardless of the cost, the resulting rebuild is likely to have a positive impact on the US economy. WTI was down over 3.5% on Monday, trading as low as $46.27pb; levels not seen since July, as the markets are concerned that US refineries will not be able to operate at the high run rates they had in July and August, therefore reducing demand for crude oil.

The US Commerce Department released data on Monday showing that the goods trade gap increased 1.7% to $65.1 billion in July. Exports declined 1.3%, weighed down by an 8% drop in motor vehicles shipments. Data also showed decreases in exports of consumer goods, however, capital goods exports rose 1.5%. Whilst inventory data is weak, the markets are remaining optimistic that inventory investment will contribute to Q3 growth.

EURUSD traded to a 2 and a half year high on Monday at 1.1975. EUR benefitted from the lack of information from ECB President Draghi in regards to the ECB’s next steps in monetary policy. Overnight EURUSD strengthened to 1.1985 and is currently trading around 1.1975.

USDJPY was sold because of North Korea’s missile test, as the markets moved into the traditional safe haven Yen. USDJPY, down 0.5%, traded as low as 108.33 in early Tuesday trading. Currently, USDJPY is trading around 108.85.

GBPUSD traded higher on Monday, as the U.K. and European Union’s (EU) third round of Article 50 negotiations began with officials meeting in Brussels. The markets are expecting the UK to offer a softer stance with regards to immigration and future ties. Currently, GBPUSD is trading around 1.2945.

Gold increased over 1.2% on Monday, to trade as high as $1,307.61; levels not seen since November last year. Lower US Treasury yields and weaker equity markets have resulted in Gold bulls returning to the market. With the recent missile launch by North Korea, demand has increased for safe havens with Gold reaching a high of $1,324.33 in early Tuesday trading. Gold is currently trading around $1,317.

WTI fell over 3.5% on Monday to a low of $46.27pb, but has recovered in early Tuesday trading to currently trade around $46.95pb.

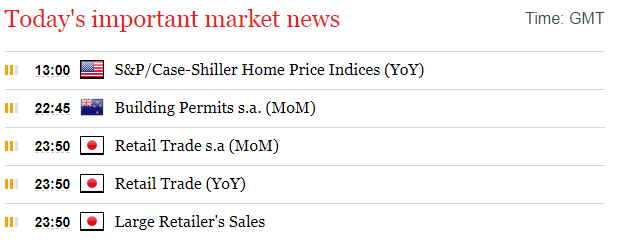

Tuesday is a relatively light day for impactful economic data releases.

At 13:00 BST, the S&P/Case Shiller Home Price Indices (YoY) for June will be released. Consensus suggests an unchanged reading of 5.7%. The US housing market appears to be relatively strong so markets will be expecting an unchanged or, potentially, stronger reading which may provide some respite for the currently poor performing USD.

Source: Fxpro Forex Broker

Fxpro Forex Broker Review and Details

Categories :

Tags : ECB President Draghi North Korea and Japan