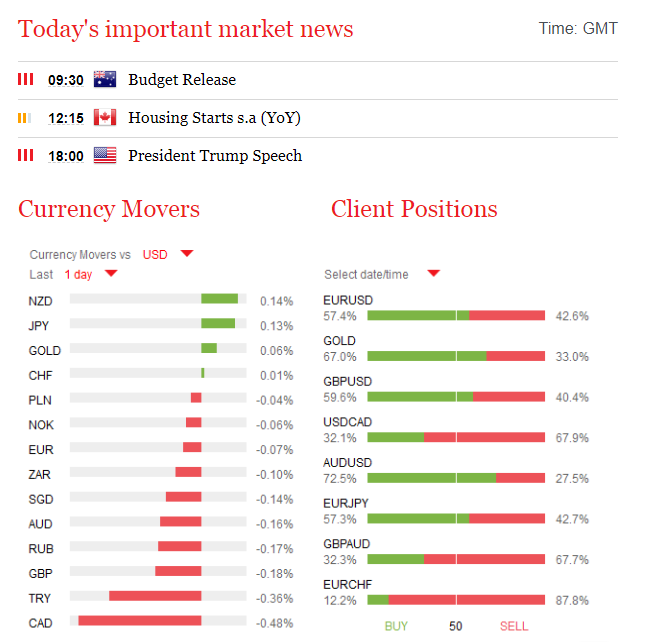

Oil News – During yesterday’s trading session Crude Oil WTI rose above $70 for the first time since 2014, as US President Trump announced that he would reveal his decision on the Iran Deal today at 18:00 GMT. The indications are that he will withdraw from the agreement, calling it one of the “worst deals ever made”. This is despite strong pressure from European allies to stay the course and make amendments if necessary. The price is up 10% over the last month due to this concern so it is possible that there is a “buy the rumour sell the fact” trade taking place, as the price has dropped back from yesterday’s high.

Swiss Consumer Price Index (YoY) (Apr) came in at 0.8% against an expected 0.9%, from the previous 0.8%. Inflation has been rising since it bottomed in 2015, with the current level not seen since 2011. Increases in fuel prices are among the main contributors to the higher readings. USDCHF moved higher from 1.00233 to 1.00294 following this data release.

US Consumer Credit Change (Mar) came in at $11.62B v an expected $16.00B, against a previous $10.60B, which was revised up to $13.64B. This data release shows a continued decline in consumer credit, with the data down from last month when the higher revision is taken into account. The data missed its consensus by a wide margin and the metric has more than halved since the January high of $28.05B. Credit card debt fell by the largest amount in more than five years, down $2.6B. GBPUSD fell from 1.35664 to 1.35541 after this data release.

Australian Retail Sales (MoM) (Mar) fell to 0.0% against a consensus of 0.3%, from 0.6% previously. The lower number suggests that the RBA will have to continue its policy of holding rates steady for some time. This came after the beat last month, with the AUD reacting badly to the data release, falling from 0.75212 to 0.74918.

EURUSD is down -0.05% overnight, trading around 1.19163.

USDJPY is down -0.02% in early session trading at around 109.075.

GBPUSD is down -0.03% this morning, trading around 1.35523.

USDCAD is up 0.21% overnight, currently trading around 1.29085.

Gold is down 0.15% in early morning trading at around $1,312.10.

WTI is down -0.03% this morning, trading around $69.93.

EUR/USD Intraday: the downside prevails.

Pivot: 1.1950

Our preference: short positions below 1.1950 with targets at 1.1895 & 1.1880 in extension.

Alternative scenario: above 1.1950 look for further upside with 1.1980 & 1.2010 as targets.

Comment: as long as the resistance at 1.1950 is not surpassed, the risk of the break below 1.1895 remains high.

GBP/USD Intraday: the bias remains bullish.

Pivot: 1.3535

Our preference: long positions above 1.3535 with targets at 1.3585 & 1.3620 in extension.

Alternative scenario: below 1.3535 look for further downside with 1.3515 & 1.3490 as targets.

Comment: the RSI lacks downward momentum.

AUD/USD Intraday: under pressure.

Pivot: 0.7530

Our preference: short positions below 0.7530 with targets at 0.7475 & 0.7460 in extension.

Alternative scenario: above 0.7530 look for further upside with 0.7545 & 0.7560 as targets.

Comment: the RSI shows downside momentum.

Gold spot Intraday: caution.

Pivot: 1310.0000

Our preference: long positions above 1310.00 with targets at 1317.00 & 1319.00 in extension.

Alternative scenario: below 1310.00 look for further downside with 1306.00 & 1301.50 as targets.

Comment: the RSI is mixed and calls for caution.

Silver spot Intraday: bullish bias above 16.3400.

Pivot: 16.3400

Our preference: long positions above 16.3400 with targets at 16.5800 & 16.6500 in extension.

Alternative scenario: below 16.3400 look for further downside with 16.2600 & 16.1900 as targets.

Comment: even though a continuation of the consolidation cannot be ruled out, its extent should be limited.

Crude Oil (WTI) (M18) Intraday: under pressure.

Pivot: 70.3000

Our preference: short positions below 70.30 with targets at 69.50 & 68.95 in extension.

Alternative scenario: above 70.30 look for further upside with 70.80 & 71.10 as targets.

Comment: the RSI is capped by a declining trend line.

Source:

Categories :

Tags : Forex Broker Oil News