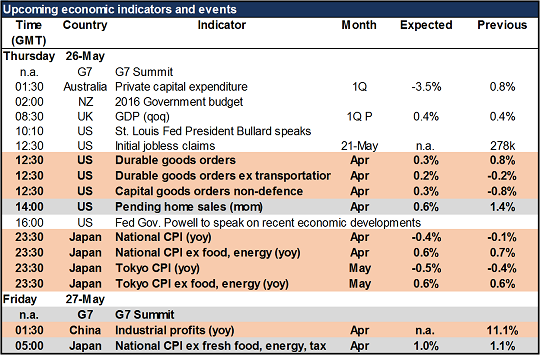

pending home sales – There are no major indicators out during the European day Thursday. The second estimate of UK GDP will be released, but that’s more of interest to see the breakdown of growth rather than any major change in the estimated rate of growth. Thus the impact on the FX market should be marginal if at all.

The North American day starts with US durable goods. They’ve largely trended sideways over the last year and this month’s data is not likely to break the pattern, especially as demand for energy-related equipment remains weak.

New home sales for Aprilwere the highest since 1992. It will be interesting to see if pending home sales are also surging. There’s some talk that the sharp rise in new home sales was due to the change in when Easter took place (April in 2015, March in 2016), and that there might be some payback in May. If however pending home sales surge too, then it might confirm the strength of the housing market.

Late in the day – Friday morning Tokyo time – Japan announces its CPI. The figures are expected to show inflation slowing or deflation worsening, depending on which figure you look at. Even the Bank of Japan’s new inflation measure, which excludes fresh food, energy, and the impact of tax hikes is expected to slow. The question is, is that good news or bad? Recently Japan has been in a “bad news is good news” regime where signs of weakness in the Japanese economy suggest that the Bank of Japan is likely to take further stimulus measures, which boosts the stock market and thereby causes USD/JPY to move higher (i.e., the yen to weaken). Slowing inflation could therefore dampen the recent rally in JPY.

Source: Fxprimus Forex broker (Review and Forex Rebate Up to 85%)

Categories :

Tags : forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf forex tutorials for beginners pdf FX Market how to trade forex for beginners pdf learning forex trading pdf Pending home sales USD/JPY