Today’s US nonfarm payrolls report for January

Source: Fxprimus Forex BROKER (Review and Forex Rebates Up to 85%)

1330 GMT: US nonfarm payrolls (Jan) Today will be spent waiting for the US nonfarm payrolls report, the big indicator of the month. Strong employment data should encourage the Fed to keep hiking while any weakness might convince them to stand pat for longer.

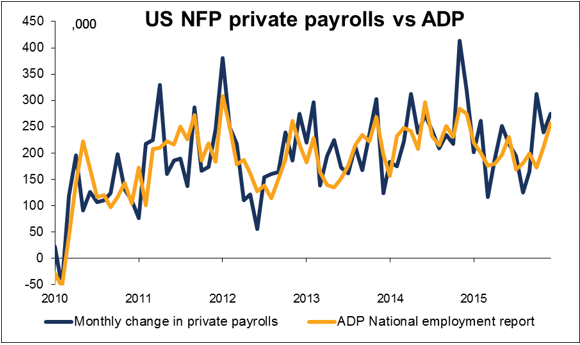

The market is looking for a relatively robust rise in payrolls of 190k, but after the stronger-than-expected ADP report of 205k, some people may have upped their forecasts. That would be a bit below the recent trend (229k a month over the last six months) but that would be quite reasonable after the enormous December (292k) and October (307k) increases. The market will also pay attention to any revisions to those earlier strong figures.

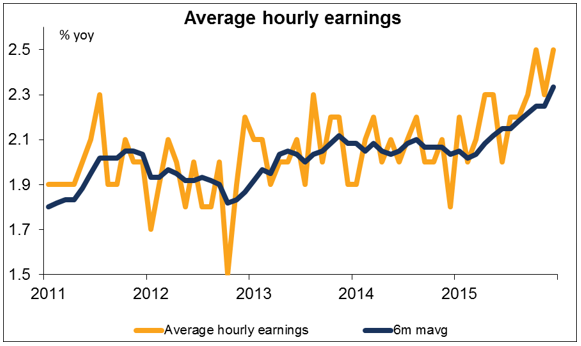

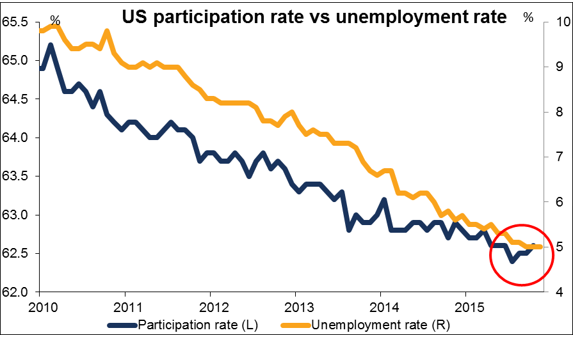

To be really supportive of the dollar, the figure would also have to show a rise in earnings and a rise in the participation rate,which are announced at the same time.

The reason is, the Fed wants to see a healthy job market. One part of that is that demand for labor should be rising and therefore the cost of labor should be rising. This has been happening; the rate of growth in earnings has accelerated from an average of 2.0% yoy in 2014 to 2.2% in 2015, and it was 2.5% yoy in December. However, the market is forecasting that the rate of growth in average earnings fell back to 2.2% yoy in January. That could be a negative for the dollar.

Another aspect of a healthy labor market should be more people coming off the unemployment rolls and into the work force. That would mean a continued rise in the participation rate. The participation rate hit a bottom of 62.4 in September and has since crept up to 62.6. That’s still low but at least the trend is upwards. No forecast is available for this indicator.

Categories :

Tags : forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf forex tutorials for beginners pdf how to trade forex for beginners pdf learning forex trading pdf nfp NFP News