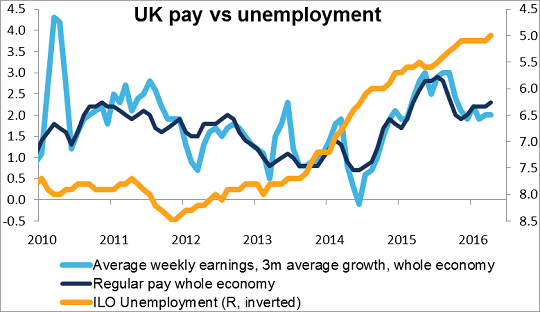

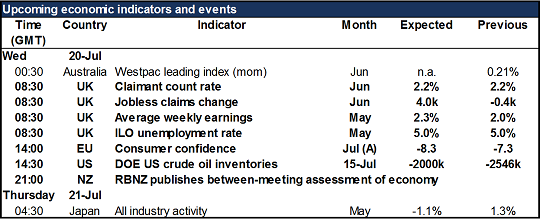

UK employment data, EU consumer confidence, RBNZ special economic assessment – Once again the UK is in the spotlight with the employment data for May and June. The headline three-month moving average of unemployment is expected to stay unchanged at 5.0% and the claimant count rate also is expected to remain stable. The other data is contradictory: jobless claims are expected to rise slightly, which would be consistent with some pullback in hiring ahead of the referendum, but average weekly earnings are expected to accelerate, perhaps as a result of the continuing influence of theNational Living Wage increase. All in all, I would expect the figure to be GBP-positive, although as we saw yesterday with the higher-than-expected CPI figure, the market isn’t necessarily reacting in such a predictable fashion to UK indicators.

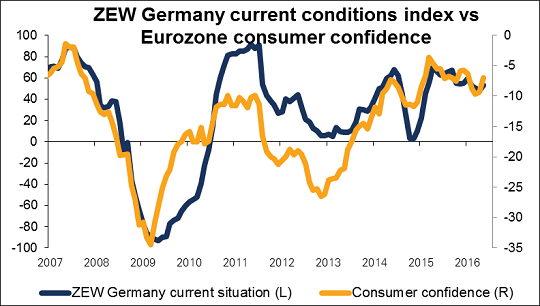

The EU consumer confidence survey is important as one of the first indicators of the impact of the Brexit vote on the EU consumer. The ZEW index of German financial analysts fell sharply yesterday; are these analysts representative of consumers as well? This figure is potentially EUR-negative, although here too we didn’t see much of an impact on the market from a figure that was outside expectations yesterday.

Source: Fxprimus Forex Broker (Review and Forex Rebates Up to 85%)

Categories :

Tags : CPI figure employment data forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf forex tutorials for beginners pdf how to trade forex for beginners pdf learning forex trading pdf UK indicators