US Dollar Could Make A Pullback In The Near-Term – The dollar fell sharply on Friday following the weak jobs report for May, but as the markets opened today, there is evidence that the dollar could be seen retracing some of its gains, leading to a pullback in the EURUSD, USDJPY and gold prices in the near term. Today’s main event risk will be speeches from Fed Chair, Janet Yellen, and FOMC voting member, Eric Rosengren.

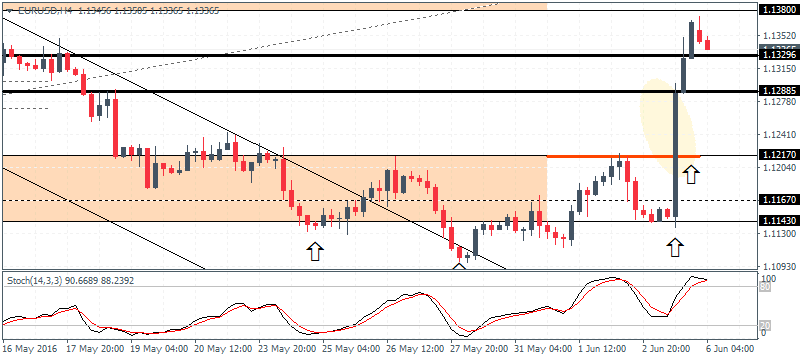

EURUSD Daily Analysis

EURUSD (1.133): EURUSD closed sharply higher on Friday, posting a two-week high above 1.1368 after price action validated the H4 inverse head and shoulders pattern. Currently, we see a bearish divergence on price and the pullback could see EURUSD slide towards 1.1216 to retest the broken resistance level of the inverse head and shoulders pattern. Establishing support here could keep the bias to the upside for a move to 1.138 – 1.140 resistance zone. Alternately, failure to find support at 1.1216 could see EURUSD slide back into the support level.

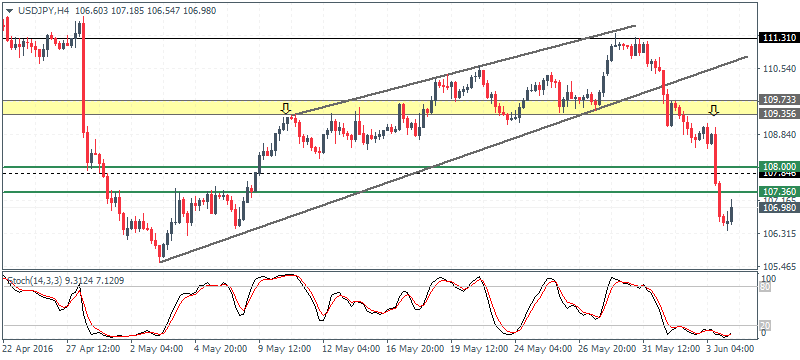

USDJPY Daily Analysis

USDJPY (106.9): USDJPY slid below 107.5 level on Friday but so far prices have managed to make a higher low. As long as the previous low near 106.2 – 105.5 is not breached, the bias remains to the upside, provided USDJPY can break out above the 107.5 – 108 level of support. On the 4-hour chart, USDJPY is attempting to retrace its declines with 107.36 coming in as the first level of resistance that could keep prices pressured to the downside. Only a close above this level could see USDJPY moving into a sideways price action.

GBPUSD Daily Analysis

GBPUSD (1.438): GBPUSD is currently trading below 1.4425 support level, gapping lower on today’s open. Prices have briefly tested the 1.435 – 1.4358 support level briefly but a confirmed close at this support could see the momentum turn back to the upside. Watch the unfilled gap which could be likely closed this week if the support holds.

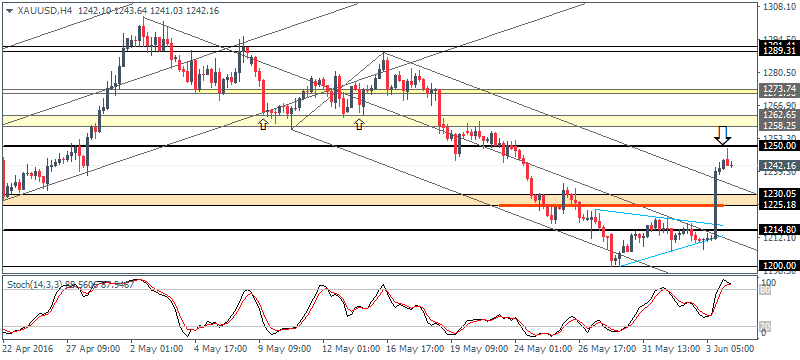

Gold Daily Analysis

XAUUSD (1242): Gold prices are currently bearish following Friday’s gains to 1243 levels. The bias remains to the upside with gold breaking out from the falling median line. A retest of the breakout level could see gold prices test back the 1230 – 1225 region ahead of further upside towards 1250 and finally to the 1258 – 162 level of resistance.

Source: Orbex Forex Broker (Review and Forex Rebates Up to 85%)

Categories :

Tags : break out EUR/USD forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf forex tutorials for beginners pdf how to trade forex for beginners pdf learning forex trading pdf USD/JPY USDJPY Daily Analysis