USD bears returned to the market as the tensions between North Korea and the US have greatly “cooled” this week. North Korean media reported that North Korea Leader Kim had delayed his decision to fire missiles towards Guam while he waited to see what the US did next. On Wednesday, President Trump praised North Korean leader Kim Jong Un for a “wise” decision. Minutes, released on Wednesday, from the Fed’s July meeting showed the central bank growing warier about recent weak inflation data, with some policymakers wanting proof of inflation moving towards the Fed’s 2% rate before deciding on the next rate hike.

In addition, the minutes also revealed that the uncertainty surrounding the fiscal, healthcare, and trade policies was holding back business investments – which will hamper domestic growth. The CME FedWatch tool is indicating that the markets are pricing a 46.8% probability of a 0.25% rate hike in December. GBP gained following data that revealed UK wages rose faster than expected in the three months to June, and the unemployment rate fell to 4.4% – its lowest since 1975.

EURUSD rose overnight to a high of 1.17896 following data that revealed Eurozone Q2 was revised to 2.2% (prev. 2.1%). EURUSD is currently trading around 1.1770

USDJPY declined 0.4% overnight hitting a low of 109.664. USDJPY is currently trading around 109.95

GBPUSD trades in a relatively narrow range of less than 30 pips in early trading. Currently GBPUSD is trading around 1.2890

Gold climbed 0.4% to $1,289.35 adding to Wednesday’s 0.9% increase. Gold is currently trading around $1,288

WTI edged higher but remains close to a near 4 week low touched earlier this week as US output hit a 2-year high offset by the 7th weekly drawdown in stockpiles. WTI is currently trading around $46.95pb

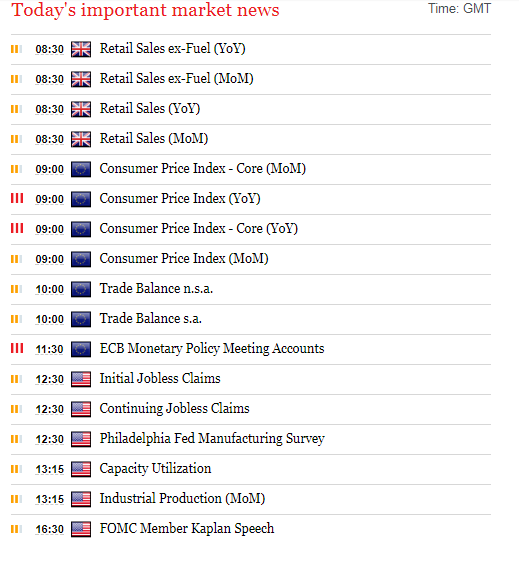

At 09:30 BST UK National Statistics will release Retail Sales for July. Forecasts are for a lower reading than previous across all time frames – notably Month-on-month expected at 0.2% (prev. 0.6%) and Year-on-year expected 1.4% (prev. 2.9%)

At 10:00 BST Eurostat will release CPI for Eurozone in July. CPI (YoY) & Core (YoY) is expected to be unchanged at 1.3% & 1.2% respectively. Any major deviation will impact ECB monetary policy with regards to future interest rate hikes.

At 12:30 BST the ECB Monetary Policy Meeting Accounts will be released. Markets will be looking at the rationale behind monetary policy decisions and economic growth prospects.

At 14:15 BST the Board of Governors of the Federal Reserve release US Industrial Production for July. Consensus calls for a decline to 0.3% from the previous reading of 0.4%.

At 17:30 BST Federal Reserve Bank of Dallas President Robert Kaplan participates in a moderated question-and-answer session at the “Dialogue with the Dallas Fed” event hosted by the Lubbock, Texas, Chamber of Commerce.

Source: Fxpro Forex Broker

Categories :

Tags : CPI for Eurozone USD Bears