Watch for a near term pullback in USD(2016.04.15)

Source: Orbex Forex Broker (Review and Forex Rebates Up to 85%)

The markets continue to edge along with the US dollar finding support from some BoJ officials earlier today. However, the current scenario is pointing to a short term pullback in prices ahead of resuming the trends with EURUSD and USDJPY most likely to benefit while caution is required for Gold which could see another leg to test the $1250 handle.

EURUSD Daily Analysis

EURUSD (1.12): EURUSD remains biased to the downside but yesterday’s candlestick had a small body compared to the high and low which could be an early signal of an impending pullback unless prices close on a bearish note today. On the 4-hour chart, price action is trading below 1.130 but with the consolidation taking place here, we could anticipate a move to 1.130 to establish resistance. Alternately, price could continue moving lower to test the support established at 1.120 level.

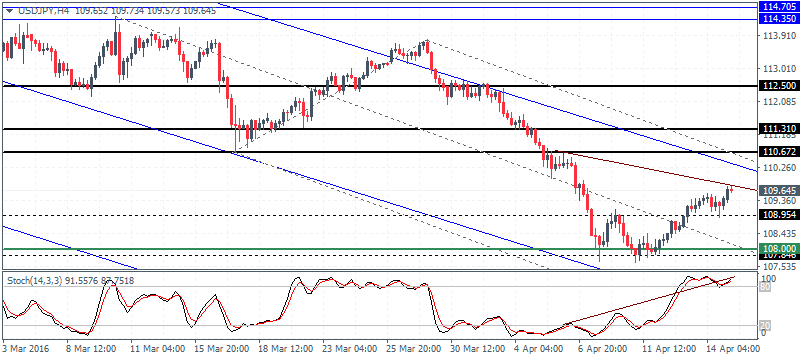

USDJPY Daily Analysis

USDJPY (109.6): USDJPY formed a doji yesterday but current price action has crossed above yesterday’s high which could indicate further upside unless prices pullback intraday. 110 will be the initial test of resistance ahead of 111.0. The hidden bearish divergence remains in play and with the previously broken resistance at 108.95 pending for a retest of support, USDJPY could be seeing a pullback in the near term.

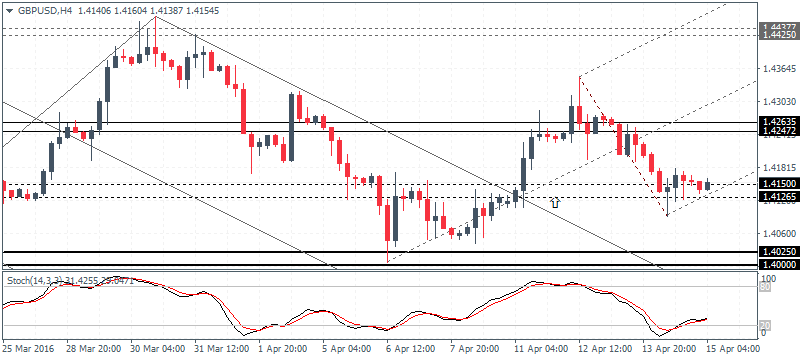

GBPUSD Daily Analysis

GBPUSD (1.41): GBPUSD remains trading in a range with no clear bias being established just as yet. With prices now back at the 1.415 – 1.4126 level of support following the test of resistance near 1.426 – 1.424, we expect GBPUSD to move into a ranging pattern. The bias remains to the upside however considering GBPUSD has posted a higher low at the current support compared to the previous low at

1.4025 – 1.40. Therefore, GBPUSD could attempt to move higher to retest the previous resistance level at 1.426 – 1.424.

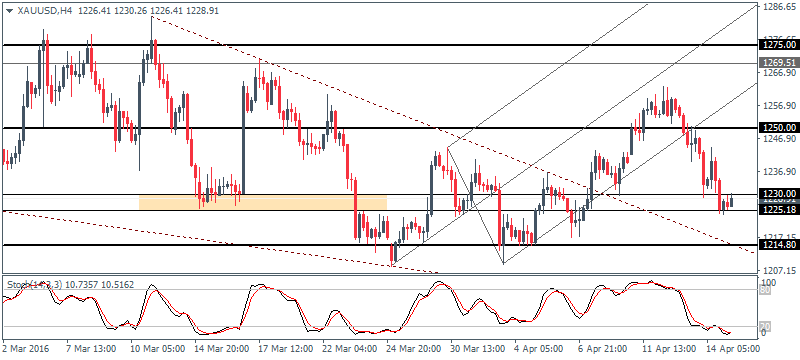

Gold Daily Analysis

XAUUSD (1228): Gold is down for the second day in a row having closed below $1230 handle. Price action is currently showing some bullish signs and could be confirmed if Gold manages to find support at the current 1230 – 1225 levels. A leg higher could see prices attempt to retest the breakout level below 1250 and if a lower high is formed here, we could anticipate further downside. However, if Gold manages to close above $1250, we could see another leg higher towards $1270 – $1275 levels in the near term.

Categories :

Tags : forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf forex tutorials for beginners pdf how to trade forex for beginners pdf learning forex trading pdf