Yen subdued after mixed data; Expectations grow of more fiscal stimulus

Source: XM Forex Broker (Review and Forex Rebates Up to 85%)

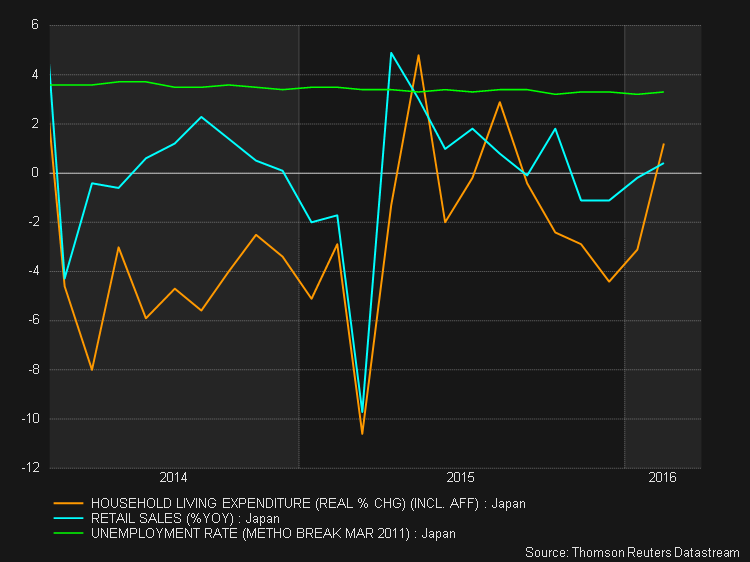

A batch of economic data released on Tuesday failed to change the gloomy outlook for Japan’s economy despite some signs of a rebound in consumer spending. Household spending in Japan jumped by 1.7% month-on-month in February after a 0.6% drop the prior month. Expectations were for a smaller increase of 0.5%. The year-on-year rate also beat estimates as a result to rise by 1.2% – the first annual increase in six months.

Also out today were retail sales and unemployment figures, which were both disappointing. Retail sales slumped by 2.3% month-on-month in February to give an annual rate of 0.5%. This was sharply below estimates of a 1.7% year-on-year rate. Jobless data also disappointed as the unemployment rate edged up to 3.3%, missing estimates that it would stay unchanged at 3.2%.

The yen saw little reaction to the mixed data as traders awaited the approval of the budget for fiscal 2016 by Japan’s parliament. The yen has been sliding against major currencies since the start of the week as expectations grow that the Japan’s government will soon announce more fiscal stimulus measures. The dollar climbed to a near two-week high of 113.79 yen before easing to 113.57 yen in mid-European session. The euro was even more bullish as it rose to a 2½-week high of 127.27 yen, while the pound was up at 161.87 yen.

Both the Bank of Japan and the government have expressed their frustration at the weak consumer spending, which has failed to benefit significantly from lower fuel prices. Businesses have also been reluctant to pass on higher corporate earnings to consumers in the form of wage increases. As markets become doubtful about the effectiveness of more monetary policy steps, pressure for addtional fiscal measures has increased.

The new budget, amounting to 96.72 trillion yen, was approved by Japan’s parliament on Tuesday, but the government has yet to decide on additional spending to boost the economy. One of the measures being considered is the possible delay of the planned sales tax increase from 8% to 10% due to take effect in April 2017. The last time the government raised the sales tax (from 5% to 8%) in April 2014, the economy went into recession as consumer spending declined sharply in subsequent months.

It is thought extra spending of at least 5 trillion yen is being considered. If the sales tax increase does go ahead as planned, the extra stimulus could amount to 10 trillion yen. According to local media, the government is unlikely to announce its decision on whether to postpone the sales tax hike before the G7 summit on May 26-27, which will be hosted by Japan. Also due by then will be the first quarter GDP data, which could show the country slipping back into technical recession.

The prospect of higher government spending hasn’t dampened expectations of more action by the Bank of Japan though. A recent Reuters poll showed a majority of economists expect the BoJ to cut rates further to -0.2% by July. The combination of further monetary and fiscal stimulus could see the yen give up some of its recent gains, which came about amid uncertainty about the pace of US rate hikes and its appeal as a safe-haven currency.

Categories :

Tags : forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf forex tutorials for beginners pdf how to trade forex for beginners pdf JPY learning forex trading pdf XM Broker