Source: Fxprimus Forex Broker (Review and Forex Rebates Up to 85%)

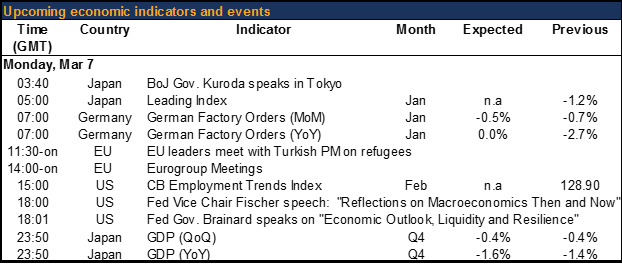

Officialdom, not indicators, will take the spotlight this weekas attention focuses on a variety of meetings around the world. Europe and the EUR will be the centre. EU leaders meet with the Turkish PM in Brussels today to discuss the refugee crisis.

So far the issue hasn’t had much impact on financial markets, but in my view it’s a more serious, intractable problem than even the Greek debacle of last year. In the near term it may increase British support for leaving the EU, which would be a catastrophe for both the UK and the EU. In the longer term, it could contribute to other countries trying to leave as well. The refugee crisis will also be the main issue in the elections in three German states on Sunday the 13th. Separately, the Eurogroup of EU finance ministers meet in Brussels Monday all EU finance minister meet on Tuesday to discuss Greece, Cyprus (which is scheduled to exit its bailout program at the end of the month) and the Eurozone’s draft budgetary plans, among other questions

Then on Thursday, the ECB meets to set monetary policy. Expectations are high that the staff will produce new, lower economic forecasts and the Council will loosen policy further as a result. Assuming that they are careful not to repeat the mistakes of January and that they therefore take big enough steps to surprise the market, the EUR should weaken and European stocks should rally. The main questions are a) will they cut the deposit rate by more than 10 bps and b) what else will they do?

The Bank of Canada meets on Wednesday and the Reserve Bank of New Zealand (RBNZ) meets Thursday NZ time (late Wednesday GMT). Neither is expected to change rates, so the focus will be on any change in stance. With oil prices firming and the Canadian budget due to be announced on March 22nd, the BoC will probably take a “wait and see” view and maintain its current stance. That could keep USD/CAD on a declining trend. Most analysts also expect the RNBZ to remain on hold even though back in January Gov. Wheeler held out the possibility of further cuts. The market does expect a cut sometime this year, just not this month.

Categories :

Tags : ads securities no deposit bonus forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf Forex News forex no deposit bonus forex no deposit bonus 2016 forex tutorials for beginners pdf hot forex no deposit bonus how to trade forex for beginners pdf Latest Forex News learning forex trading pdf no deposit bonus forex no deposit bonus forex august 2016 no deposit sign up bonus