EUR/USD Analysis (2015.12.29)

Source: FXCC Forex Broker (Review and Forex Rebates Up to 85%)

The two largest economic power poles in the world are indisputably the European Union and the United States of America. The dollar, also called Greenback, is the world’s most traded currency as well as the most widely held, making EUR/USD the most popular and traded currency pair.

Due to its on-going state of liquidity, the pair offers very low spreads as the first choice of any trader seeking a profit from investing in the financial markets. Informed trading decisions and a wide array of trading strategies can be applied to this pair, due to the rich source of economic and financial data influencing the direction of its market price. Therefore, plenty of open opportunities to make huge financial profits arise from the ever-changing level of volatility this pair is characterized by.

The direction of the EUR/USD trading market price is dictated by the comparative strength of these two major leading economies. Simply explained, if all else remains contacts and the American economy registers a rapid growth, it will cause the Dollar to strengthen against a weaker Euro. The opposite is true if the Eurozone experiences a growth of its economy, which will lead the Euro to a stronger state, in comparison to the Dollar which will weaken.

One of the major influences in the change of the relative strength is the level of interest rates. When the interest rates of the American currency are stronger than those of the key European economies, it accounts for a firm U.S. currency against the Euro. If the interest rates on Euro are strong, the Dollar normally drops. Having stated this, the interest rates alone do not dictate the movement of the currency market prices.

The dynamic of EUR/USD is highly dominated by the political instability of the Eurozone, as it is widely recognized fact that the Eurozone is a testing ground for economic and monetary policies. The variety of unforeseen changes and differences between the countries that comprise the EU account for a stronger Dollar against the Euro.

These are the EUR/USD trading features you need to know before investing in the most popular currency pair in the market.

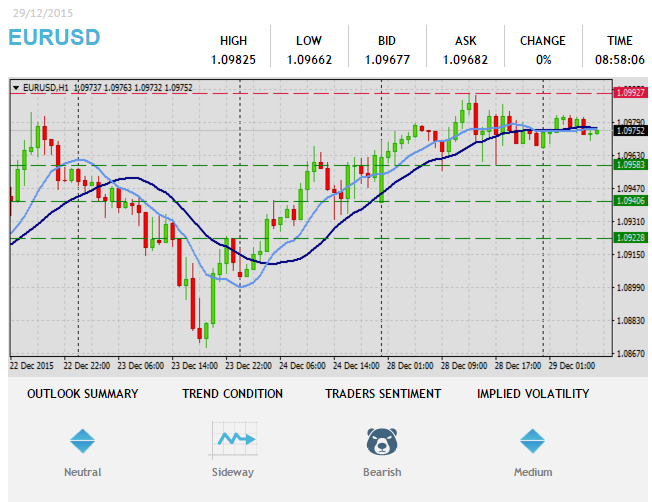

EUR/USD Chart

MARKET ANALYSIS – Intraday Analysis

Upwards scenario: Neutral hourly studies point towards to further consolidation pattern, with a break of next resistive structure at 1.0992 (R1) is required to spark stronger upside action. In such case we would suggest next initial targets 1.1013 (R2) and 1.1031 (R3). Downwards scenario: Any downside fluctuations remains for now limited to the next support level at 1.0958 (S1), only clear break here would be a signal of further market easing towards to next targets at 1.0940 (S2) and 1.0922 (S3) in potential.

Resistance Levels: 1.0992, 1.1013, 1.1031

Support Levels: 1.0958, 1.0940, 1.0922

Categories :

Tags : binary options demo account binary options trader EUR/USD EUR/USD News EURO forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf forex tutorials for beginners pdf how to trade forex for beginners pdf learning forex trading pdf