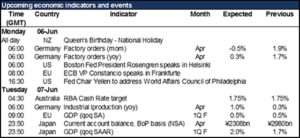

Important Indicators and Events – This week is bound to be quieter than last week was: no ECB meeting, no OPEC meeting, no nonfarm payrolls, and the members of the Federal Open Market Committee (FOMC) enter their “purdah” period a week before their next meeting. After Fed Chair Janet Yellen gets done speaking on Monday, there will be no more comments from senior Fed officials until June 16th.

The focus then will be on Yellen’s speech in the first instance. Unlike her recent speech at Harvard, this one will be all policy. The markets will be looking for a substantial statement, in particular how she sees the weak May payroll figure plus the Brexit vote affecting the chance of a rate hike in June or July. My assumption is that she will reaffirm her confidence that the economy remains on track for further tightening and that her statement will firm up the dollar – but tune in to find out yourself.

Yellen will be followed by the two rate decision due this week: the Reserve Bank of Australia (RBA) on Tuesday and the Reserve Bank of New Zealand (RBNZ) on Thursday (NZ time).

There’s little debate about the likely result of the RBA meeting: the market is pricing in only a 12% chance of a cut. The recent news from Australia has been generally encouraging: Q1 GDP rose more than expected, private sector credit growth is accelerating, building approvals are up, and unemployment is falling. There hasn’t been enough bad news since the last meeting (3 May), when they cut rates by 25 bps, to justify another cut. AUD/USD is only slightly stronger (0.73 vs 0.75) so I do not expect much stronger language about the currency in the statement. All in all, this meeting could be a relatively uneventful one for the markets.

For the RBNZ however there’s much more disagreement. Of the 15 economists polled on Bloomberg, eight see a cut and seven say no. The market on the other hand attaches only a 32% chance to a cut. Although inflation is low, the economy is doing well as rapid population growth fuels domestic demand. In my view, once again I don’t think there’s been enough bad news since the last rate cut in March to justify moving again. I too expect that they will remain on hold, which may see NZD firm somewhat.

Elsewhere, we’ll get some evidence on the real economy during the week from various countries’ industrial production and trade data. Monday is factory orders from Germany, followed by the country’s industrial production on Tuesday and trade & current account balance on Thursday. Factory orders are forecast to slow even though industrial production is expected to rise, suggesting that future production could suffer. That could be EUR-negative. The current account balance is expected to decline significantly but still remain huge, one of the major causes of imbalances in the Eurozone and indeed globally.

Source: Fxprimus Forex Broker ( Review and Forex Rebates Up to 85%)

Categories :

Tags : binary options demo account Eurozone forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf forex tutorials for beginners pdf how to trade forex for beginners pdf Important Indicators learning forex trading pdf nonfarm payrolls NZD RBNZ