USD/JPY Fundamental Analysis

The USD/JPY dipped 55 points as the greenback eased and the Bank of Japan Governor continued his stance that no new stimulus would be added at this week’s event. The yen is trading at 120.55. The climb in yen implied volatilities finally begins to track euro and dollar, indicating increased bets that the European Central Bank may force the Bank of Japan to act, after ECB president Mario Draghi said Thursday he will investigate all options for more stimulus in December. Pressure is also stemming from events closer to home as the People’s Bank of China announced on Friday that it will cut benchmark lending and deposit rates by 25 basis points as well as lower banks’ reserve ratio requirement by at least 50 basis points.

The Bank of Japan need not boost its massive monetary stimulus this week as the labor market remains tight, a key economic adviser to Prime Minister Shinzo Abe said on Monday.Koichi Hamada, an emeritus professor of economics at Yale University, also told Reuters that the central bank does not have to rush into further easing but rather can monitor the prospects for an interest rate hike by the United States. “As long as the jobs-to-applicant ratio and unemployment rate show the labor market remains tight, the BOJ can wait for a while,” Hamada said in an interview.

Most traders are sitting tight waiting for the FOMC decision tomorrow.

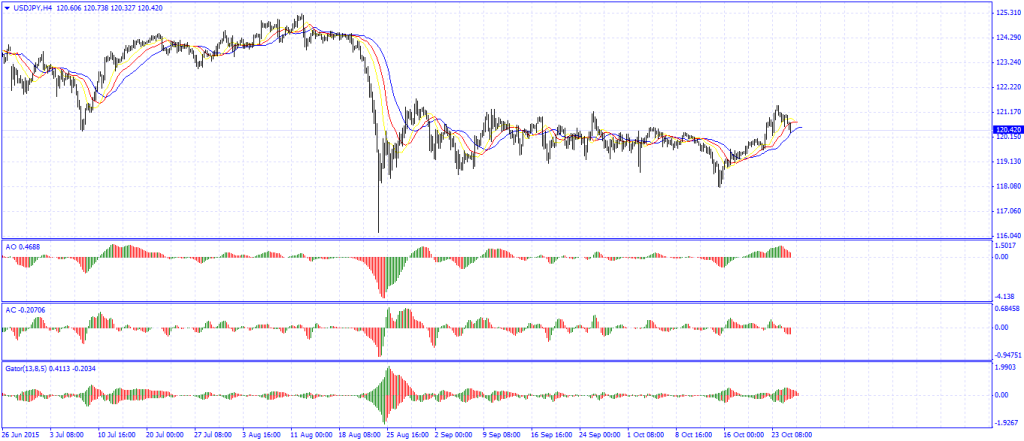

USD/JPY Chart

Source:Fxempire

Categories :

Tags : ads securities no deposit bonus forex no deposit bonus forex no deposit bonus 2016 hot forex no deposit bonus no deposit bonus forex no deposit bonus forex august 2016 no deposit sign up bonus USD/JPY Chart USD/JPY Fundamental Analysis