5/13/62 Strategy – Since the dawn of time man has sought ways to more easily provide for himself and his family. And women too, of course! Evolution has always been an equal-opportunity extinction machine.Somewhere along the way, humankind over complicated the struggle for survival. We invented jobs, and bosses, and weekly paychecks. Worse yet, we invented meetings, annual reviews, copy machines, bookkeeping, cubicles, and voice mail.

Then we invented Prosac and Lipitor and Viagra because, somewhere along the way, our bodies decided that if we didn’t give them a rest they would start shutting down essential functions.This ebook is my attempt to teach you that you don’t have to take a pill in order to be a great trader. You just need to focus on some simple tools. But first we need to talk about something totally separate from trading.

Her name was Carrie.

She was the first girl I thought I liked, or loved, or whatever. She sat next to me in a 7th grade class. I don’t remember much about the class,mostly because I was spending so much time concentrating on Carrie. Most of the time, she was my friend. Except when we were outside of class.Outside of class, she paid no attention to me. She ignored me. If she ever talked to me, she made fun of me, refused to spend time with me (or even admit I existed). Of course this only made matters worse. All of this only made me want her more. Carrie moved away after the 7th grade.

5 years later I found myself standing behind her at the market.Every feeling I’d ever had for her returned instantly.

I was so entranced that I watched her as she left the drugstore, got into her car, and pulled out of the parking lot. Just when I thought that she neither remembered me, or even noticed me, she turned around,rolled down her window, and blew me a kiss. My heart jumped into my throat and I felt weak.I never saw Carrie again.

You know what a pip is already. For purposes of this booklet,we’re drawing it as a yellow cube. Do you know that most forex traders spend their careers chasing after pips in the same way I chased after Carrie’s attention? She never gave it to me, unless (at the end) it was to blow me a teasing goodbye kiss. She had received all the benefit from

my attention and never gave anything back except a blow to my selfes teem. Gosh, that sounds a lot like when I first traded currency – and the pips teased me until they simply moved away in the end, with a good-bye kiss.

Have you ever watched the market and wondered why the harder you tried, the more quickly the pips distanced themselves from you? I remember when I first started trading that the market would move away from me and I would begin to think: it’s moving. Why is it moving away from me? Couldn’t it just as easily move in my direction?

For a while, I made money on gut decisions. I’d make some progress, a few pips or more a day, but never really understand the

signals. For instance, I’d make a profit just barely, and watch in horror / relief as the market swung the opposite way right after I exited the trade.Or I’d enter a trade, lose a bunch of pips, and then exit the position at a loss – only to watch the market swing back in my favor. Only, of course, the position was closed and all I could do was sit there and

watch, just like I had stood in the parking lot of the drugstore, watching Carrie blow that goodbye kiss.

What I learned

Until you’re no longer impressed with pips – no longer frightened by them, nor infatuated by them, not in love with them, no longer simply hating them – they won’t give you the time of day. The acquisition of pips is your only goal in the currency market. But pips are fickle and if you pursue them full of emotion, you’re going to get burned.I learned in the drugstore that day 20 years ago that Carrie would have paid attention to me if I had simply ignored her every once in a while. If I had been able to get my feelings under control. If I’d been able to act cool instead of like a freak. If I’d been able to calmly make a plan, stick to it. But I could do none of those things. My emotions took hold of me and turned me into an idiot.

It’s the same for pips. We all want them. We all want as many of them as we can get. But some of us are willing to risk everything for just a few of them. We’ll chase after them like a 12-year old boy. And you know what? They don’t give a damn about you and me.This ebook will present a plan for learning about pips, where they’re going, what they’re about to do, and then arm you with a strategy that once implemented, can take a lot of the emotion out of trading.

Your goal will be to:

1. Enter positions as soon as a particular signal is given.

2. Exit the position as soon as a particular signal is given.

The payoff will be:

1. The emotion should be gone from the trading. You will enter and exit trades with discipline and focus.

2. You’ll get about 20 pips on the good trades. There will be many more good trades than bad ones.

Attitude is 99% of Trading

Developing the right attitude about your trading is most of the work. Once you get your attitude (your discipline) under control, you’re going to have more pips than you know what to do with. So much has been written about this that you’d think that you’ve already heard enough about it. I’ve written about it elsewhere, too1, but I’ve got to

stress that no technique or strategy is worth more than the discipline you have to implement it.

The 5/13/62 strategy requires discipline. This is the most powerful personal characteristic you can acquire. Period. It will earn you more money and success than any other attitude or personality trait. If you’re low on discipline, please take the time to consider what I’m saying:

In trading, discipline simply means two things:

1.Enter a position as soon as a particular signal is given.

2. Exit the position as soon as a particular signal is given.

If you do not acquire discipline, this system will not work for you.No trading system will work for you. But this isn’t a book about discipline. In fact, this book assumes that you have discipline, or you’re willing to acquire in order to implement a profitable trading system. So, for the purpose of this discussion, and for the testing of this strategy, please be disciplined – even as you practice.

EMAs are the core of the 5/13/62 Strategy

Exponential Moving Averages (described in more detail below) are at the core of tis strategy. From the beginning you should understand that I didn’t invent the 5/13/62 strategy. At least I don’t think I did. There are some extras that I add in, but essentially, all of this information is available elsewhere. That said, I believe that most of the people that

write about forex have a way of putting you and I to sleep. So maybe this is the first time you’ve heard about it, but in any event, I’ll try to keep it interesting.

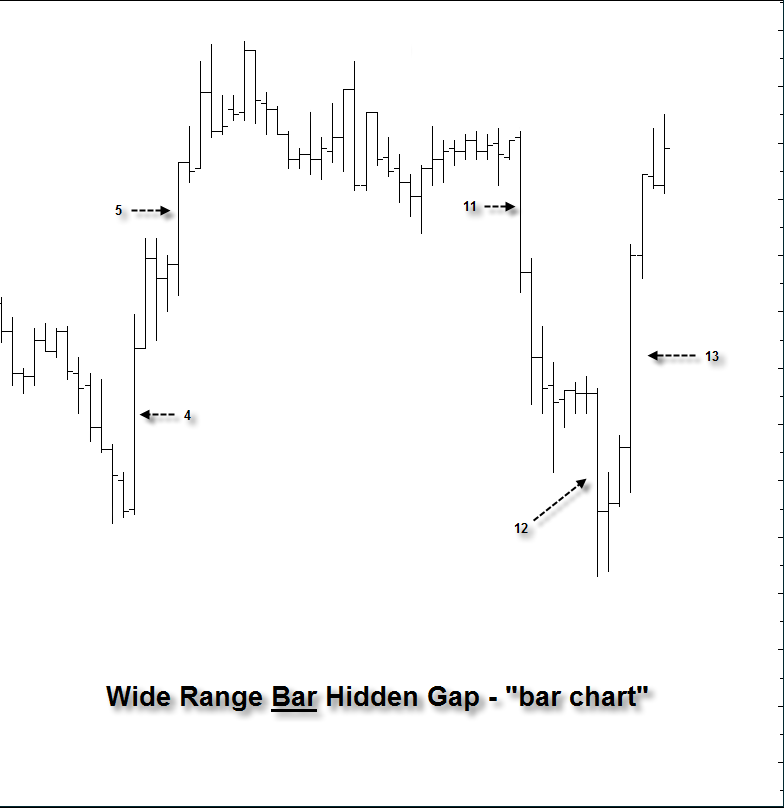

Here’s where we start. With a chart:

If the chart above doesn’t make any sense to you, even with the legend, then here’s a brief explanation:

1. The candles are easy to read. Green ones are ones that closed lower. White ones closed higher.

2. The EMA lines are crossing at the left. The 5 (red) crosses below the 13 (the yellow) and both the 5 and 13 are crossing the 62 (the blue one).

3. You can see that in this chart, the British Pound fell about 110 pips in less than a day.

That’s the chart. What can we learn immediately?

1. When the 5 crosses below the 13, and both of them cross below the 62, it’s possibly a good sell signal.

2. Inversely, we can assume that the opposite is true: when the 5 crosses above the 13, and both cross above the 62, it’s a buy signal.

What is the EMA?

Moving averages are the average value of the price of a currency pair, over a certain period of time. A 5-day moving average for the EUR/USD would be the average price of the EUR/USD over a 5 day period. You can base the average on the closing, opening, or other price. Each time the MA is calculated, the earliest period is dropped and the latest period is added. In this way, the average price fluctuates according to the fixed time period.

The exponential moving average (EMA) puts the emphasis on the most recent prices, and less emphasis on the older prices. Sometimes you won’t see much difference between the EMA and the Simple Moving Average, which does not weigh any price more than another.

Is that it? Do I just look for the crosses?

I have back tested (and so have many, many others) simply buying when the signals cross above and selling when the signals cross below.There are even companies that build trading robots that will automatically buy and sell when these signals are given. But, as much as I’d like to say differently, it’s not that easy.There are all types of false signals (crosses that happen but that don’t turn profitable).Here are some other principles of this strategy, divided in three sections: entering the trade, staying in the trade, exiting the trade. The principles of each section will help you maximize your gains and minimize your losses.

Author: R. Booker

To read More,Please download the book.

5/13/62 Strategy, 5/13/62 Strategy ebook, binary options learn, binary options strategy pdf, binary options trader, binary trading strategies pdf, Download 5/13/62 Strategy, EMA, EUR/USD, forex bonus without deposit, Forex Broker, forex broker bonus, forex learn, forex learning, forex learning pdf, forex trading learn, forex tutorials for beginners pdf, how to trade forex for beginners pdf, learn binary, learn forex market, learn forex market trading, learning forex trading online, learning forex trading pdf, trading binary options strategies and tactics pdf free, What is the EMA?

Similar Videos and E-books

LEAVE A COMMENT

All Books

For Beginners

- Candlesticks For Support And Resistance

- Online Trading Courses

- Commodity Futures Trading for Beginners

- Hidden Divergence

- Peaks and Troughs

- Reverse Divergences And Momentum

- Strategy:10

- The NYSE Tick Index And Candlesticks

- Trend Determination

- The Original Turtle Trading Rules

- Introduction to Forex

- The Six Forces of Forex

- Study Book for Successful Foreign Exchange Dealing

- Forex. On-Line Manual for Successful Trading

- 18 Trading Champions Share Their Keys to Top Trading Profits

- The Way to Trade Forex

- The Truth About Fibonacci Trading

- Quick Guide to Forex Trading

- Chart Patterns and Technical Indicators

- Forex Trading

- Trading Forex: What Investors Need to Know

- My Dog Ate My Forex

- Point & Figure for Forex

Forex Market in General

- Screen Information, Trader Activity, and Bid-Ask Spreads in a Limit Order Market

- Strategic experimentation in a dealership market

- Limit Orders, Depth, and Volatility

- Reminiscences of a Stock Operator

- Market Profile Basics

- Quote Setting and Price Formation in an Order Driven Market

- Phantom of the Pits

- An Introduction to Market Profile and a Users Guide to Capital Flow Software

- The Effect of Tick Size on Volatility, Trader Behavior, and Market Quality

- Trading as a Business

- What Moves the Currency Market?

- Macroeconomic Implications of the Beliefs and Behavior of Foreign Exchange Traders

- All About the Foreign Exchange Market in the United States

Psychology of Trading

- A Course in Miracles

- Thoughts on Trading

- Calming The Mind So That Body Can Perform

- Lifestyles of the Rich and Pipped

- The Miracle of Discipline

- Zoom in on Personal Trading Behavior And Profit from It

- The Woodchuck and the Possum

- 25 Rules Of Forex Trading Discipline

- Stop Losses Are For Sissies

- Your Personality and Successful Trading

- Trading as a Business

- The 7 Deadly Sins of Forex (and How to Avoid Them)

- The 5 Steps to Becoming a Trader

Money Management

- Risk Control and Money Management

- Money Management

- Position-sizing Effects on Trader Performance: An experimental analysis

- Fine-Tuning Your Money Management System

- Money Management: Controlling Risk and Capturing Profits

- Money Management Strategies for Serious Traders

- The Truth About Money Management

- Money Management and Risk Management

Forex Strategy

- 1-2-3 System

- Bollinger Bandit Trading Strategy

- Value Area

- The Dynamic Breakout II Strategy

- Ghost Trader Trading Strategy

- King Keltner Trading Strategy

- Scalp Trading Methods

- LSS - An Introduction to the 3-Day Cycle Method

- Market Turns And Continuation Moves With The Tick Index

- The Money Manager Trading Strategy

- Picking Tops And Bottoms With The Tick Index

- The Super Combo Day Trading Strategy

- The Eleven Elliott Wave Patterns

- The Thermostat Trading Strategy

- Intraday trading with the TICK

- Traders Trick Entry

- Fibonacci Trader Journal

- Rapid Forex

- Microtrading the 1 Minute Chart

- BunnyGirl Forex Trading Strategy Rules and FAQ

- The Daily Fozzy Method

- Forex Traders Cheat Sheet

- Offset Trading

- How to Trade Both Trend and Range Markets by Single Strategy?

- A Practical Guide to Technical Indicators; Moving Averages

- FX Wizard

- FX Destroyer

- A Practical Guide to Swing Trading

- Practical Fibonacci Methods for Forex Trading

- Using The Heikin-Ashi Technique

- The Day Trade Forex System

- 5/13/62

- Not So Squeezy Trading Manual

- KobasFX Strategy

- Killer Patterns

- 3D Trading

- 4 Hour MACD Forex Strategy

- WRB Analysis Tutorial

Advanced Forex Trading

- A New Interpretation of Information Rate

- CCI Manual

- Nicktrader and Jeff Explaining Reverse and Regular Divers

- NickTrader on No Price CCI Divergence Trading

- Are Supply and Demand Driving Stock Prices?

- The Sharpe Ratio

- The Interaction Between the Frequency of Market Quotes, Spread and Volatility in Forex

- Trend Determination

- Trend vs. No Trend

- A Six-Part Study Guide to Market Profile

- How George Soros Knows What He Knows

- Core Point and Figure Chart Patterns

- Coders Guru Full Course

- Point and Figure Charting: a Computational Methodology and Trading Rule Performance in the S&P 500 Futures Market

- Evolving Chart Pattern Sensitive Neural Network Based Forex Trading Agents

- Heisenberg Uncertainty Principle and Economic Analogues of Basic Physical Quantities

- The String Prediction Models as an Invariants of Time Series in Forex Market

- Using Recurrent Neural Networks to Forecasting of Forex

- The New Elliott Wave Rule - Achieve Definitive Wave Counts