RISK Control and MONEY Management

Money management is like sex: Everyone does it,one way or another, but not many like to talk about it and some do it better than others.But there’s a big difference: Sex sites on the Web proliferate, while sites devoted to the art and science of money management are somewhat difficult to find. There are many, many financial sites on the Web that let you track a portfolio of stocks on a glorified watch list. You enter in your open positions and you get a snapshot, or better yet a live, real-time update, of the status of your stocks based on the site’s most recently available prices. Some sites, like Fidelity’s,provide tools that tell you how your portfolio is allocated among various asset classes such as stocks, mutual funds, bonds and cash.

While such sites get at the idea of money or portfolio management, the overwhelming majority fail to provide the tools required to answer the central question of money management: “When I make a trade, how much do I trade?” (Try and find the topic of money management on the Motley Fool site.) We’ll discuss how to measure and manage trade risk and where to find the tools to help do it in a responsible and profitable manner. The key underlying

concept is to limit how much money you are willing to let the market extract from your wallet when you make losing

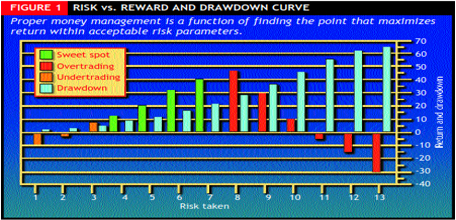

trades.When any trader makes a decision to buy or sell (short), they must also decide at that time how many shares or contracts to buy or sell — the order form on every brokerage page has a blank spot where the size of the order is specified. The essence of risk management is mak ing a logical decision about how much to buy or sell when you fill in this blank. This decision determines the risk of the trade. Accept too much risk and you increase the odds that you will go bust; take too little risk and you will not be rewarded in sufficient quantity to beat the transaction costs and the overhead of your efforts. Good money management practice is about finding the sweet spot between these undesirable extremes.

Figure 1 (below) shows the relationship between the long-term result of a series of trades and the amount of risk taken on a per-trade basis. If you risk too little on each trade,shown by the under trading zone, the returns will be too low to overcome transaction costs, small losses and overhead (quote feeds, electricity, rent, subscription

to Active Trader magazine, etc.) and trading will be a losing proposition. Risk more and the returns will increase ,

but note that the potential d r a w d o w n (account losses you will need to endure to get the return — another cost of doing business) always increases as you incre a s e the per-trade risk. Returns continue to i n crease moving into the over trading zone.

can be extremely high, and the margin of safety for dealing with unexpectedly high losing trades is very low. In other word s ,y o u ’ re getting into territory where one huge loser can blow you out. The best place to live on this curve is

the spot where you can deal with the emotional aspect of equity drawdown required to get the maximum return.

How much heat can you stand? Money management is a thermostat — a control system for risk that keeps your trading within the comfort zone.

It’s surprising that even many active traders and investors have no idea what money management is about. They generally entertain a fuzzy notion that it has to do with setting stops, and that discipline is involved to make sure you execute the stops when they are hit, but

speculative, maniacal extended leg of the bull market fueled by the dot.com land rush since 1997. This type of market

— where making money consists of taking a ride on the back of the bull trend and buying the dips — tends to turn the

merely bold (and possibly reckless) into market geniuses. The perceived risk in stock market investing has been very

low, so the need to manage that risk has not been a pressing concern. Why worry when it will always come back and you can make a killing if you buy more? More important to success than managing risk was the ability to charm your

broker into getting you into the latest IPO allocation.

To read More,Please download the book.

BY GIBBONS BURKE

Similar Videos and E-books

LEAVE A COMMENT

All Books

For Beginners

- Candlesticks For Support And Resistance

- Online Trading Courses

- Commodity Futures Trading for Beginners

- Hidden Divergence

- Peaks and Troughs

- Reverse Divergences And Momentum

- Strategy:10

- The NYSE Tick Index And Candlesticks

- Trend Determination

- The Original Turtle Trading Rules

- Introduction to Forex

- The Six Forces of Forex

- Study Book for Successful Foreign Exchange Dealing

- Forex. On-Line Manual for Successful Trading

- 18 Trading Champions Share Their Keys to Top Trading Profits

- The Way to Trade Forex

- The Truth About Fibonacci Trading

- Quick Guide to Forex Trading

- Chart Patterns and Technical Indicators

- Forex Trading

- Trading Forex: What Investors Need to Know

- My Dog Ate My Forex

- Point & Figure for Forex

Forex Market in General

- Screen Information, Trader Activity, and Bid-Ask Spreads in a Limit Order Market

- Strategic experimentation in a dealership market

- Limit Orders, Depth, and Volatility

- Reminiscences of a Stock Operator

- Market Profile Basics

- Quote Setting and Price Formation in an Order Driven Market

- Phantom of the Pits

- An Introduction to Market Profile and a Users Guide to Capital Flow Software

- The Effect of Tick Size on Volatility, Trader Behavior, and Market Quality

- Trading as a Business

- What Moves the Currency Market?

- Macroeconomic Implications of the Beliefs and Behavior of Foreign Exchange Traders

- All About the Foreign Exchange Market in the United States

Psychology of Trading

- A Course in Miracles

- Thoughts on Trading

- Calming The Mind So That Body Can Perform

- Lifestyles of the Rich and Pipped

- The Miracle of Discipline

- Zoom in on Personal Trading Behavior And Profit from It

- The Woodchuck and the Possum

- 25 Rules Of Forex Trading Discipline

- Stop Losses Are For Sissies

- Your Personality and Successful Trading

- Trading as a Business

- The 7 Deadly Sins of Forex (and How to Avoid Them)

- The 5 Steps to Becoming a Trader

Money Management

- Risk Control and Money Management

- Money Management

- Position-sizing Effects on Trader Performance: An experimental analysis

- Fine-Tuning Your Money Management System

- Money Management: Controlling Risk and Capturing Profits

- Money Management Strategies for Serious Traders

- The Truth About Money Management

- Money Management and Risk Management

Forex Strategy

- 1-2-3 System

- Bollinger Bandit Trading Strategy

- Value Area

- The Dynamic Breakout II Strategy

- Ghost Trader Trading Strategy

- King Keltner Trading Strategy

- Scalp Trading Methods

- LSS - An Introduction to the 3-Day Cycle Method

- Market Turns And Continuation Moves With The Tick Index

- The Money Manager Trading Strategy

- Picking Tops And Bottoms With The Tick Index

- The Super Combo Day Trading Strategy

- The Eleven Elliott Wave Patterns

- The Thermostat Trading Strategy

- Intraday trading with the TICK

- Traders Trick Entry

- Fibonacci Trader Journal

- Rapid Forex

- Microtrading the 1 Minute Chart

- BunnyGirl Forex Trading Strategy Rules and FAQ

- The Daily Fozzy Method

- Forex Traders Cheat Sheet

- Offset Trading

- How to Trade Both Trend and Range Markets by Single Strategy?

- A Practical Guide to Technical Indicators; Moving Averages

- FX Wizard

- FX Destroyer

- A Practical Guide to Swing Trading

- Practical Fibonacci Methods for Forex Trading

- Using The Heikin-Ashi Technique

- The Day Trade Forex System

- 5/13/62

- Not So Squeezy Trading Manual

- KobasFX Strategy

- Killer Patterns

- 3D Trading

- 4 Hour MACD Forex Strategy

- WRB Analysis Tutorial

Advanced Forex Trading

- A New Interpretation of Information Rate

- CCI Manual

- Nicktrader and Jeff Explaining Reverse and Regular Divers

- NickTrader on No Price CCI Divergence Trading

- Are Supply and Demand Driving Stock Prices?

- The Sharpe Ratio

- The Interaction Between the Frequency of Market Quotes, Spread and Volatility in Forex

- Trend Determination

- Trend vs. No Trend

- A Six-Part Study Guide to Market Profile

- How George Soros Knows What He Knows

- Core Point and Figure Chart Patterns

- Coders Guru Full Course

- Point and Figure Charting: a Computational Methodology and Trading Rule Performance in the S&P 500 Futures Market

- Evolving Chart Pattern Sensitive Neural Network Based Forex Trading Agents

- Heisenberg Uncertainty Principle and Economic Analogues of Basic Physical Quantities

- The String Prediction Models as an Invariants of Time Series in Forex Market

- Using Recurrent Neural Networks to Forecasting of Forex

- The New Elliott Wave Rule - Achieve Definitive Wave Counts